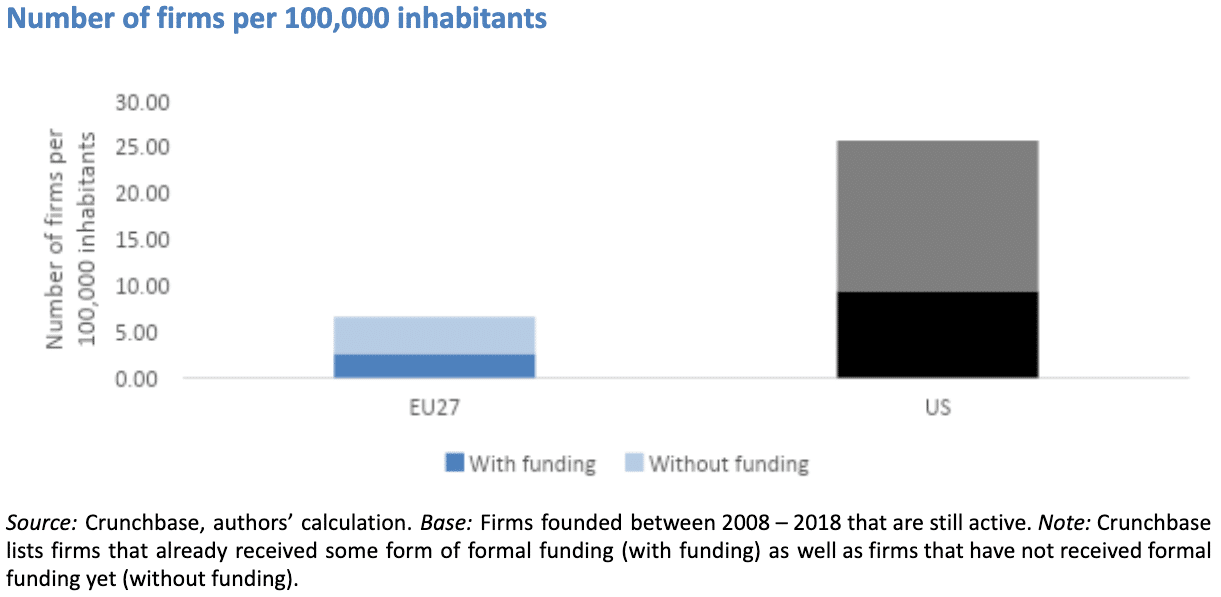

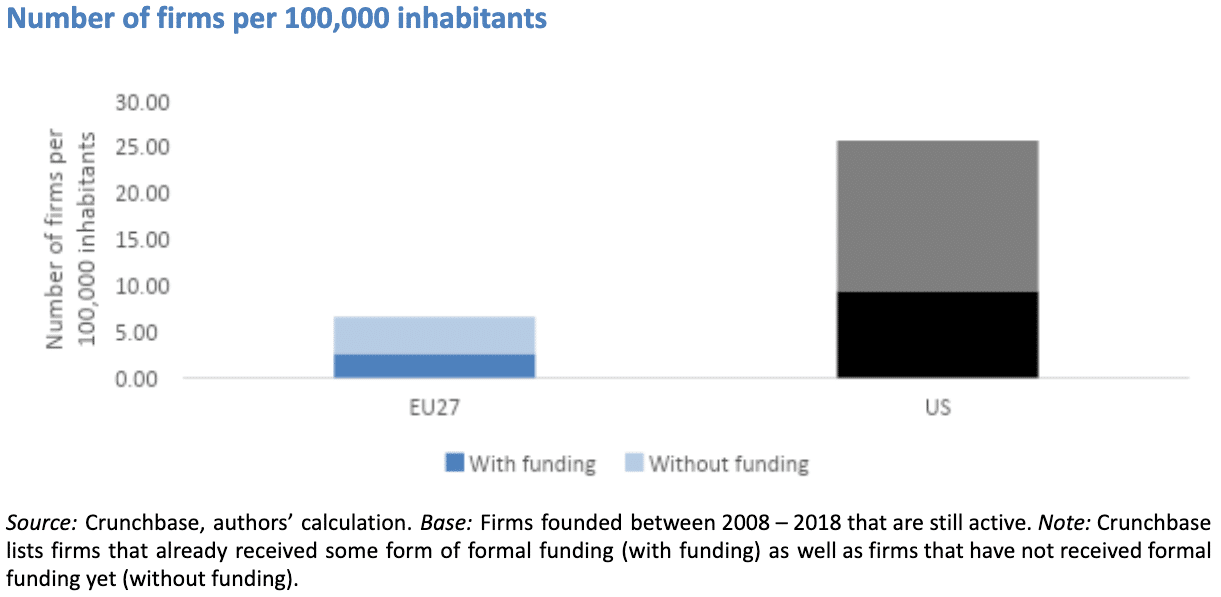

Start-ups and scale-ups play an important economic role. These firms are drivers of aggregate investment activities, carriers of innovation, and an important source of labour demand. However, the European Investment Bank Investment Report 2020, recently published in collaboration with Crunchbase, finds that despite an increase in start-up creation in recent years, Europe still lags the US in terms of number of young, innovative firms by a factor of three. This increases to a factor of four if we take into account the larger population size of Europe.

The EU has a particular gap in successful scale-ups

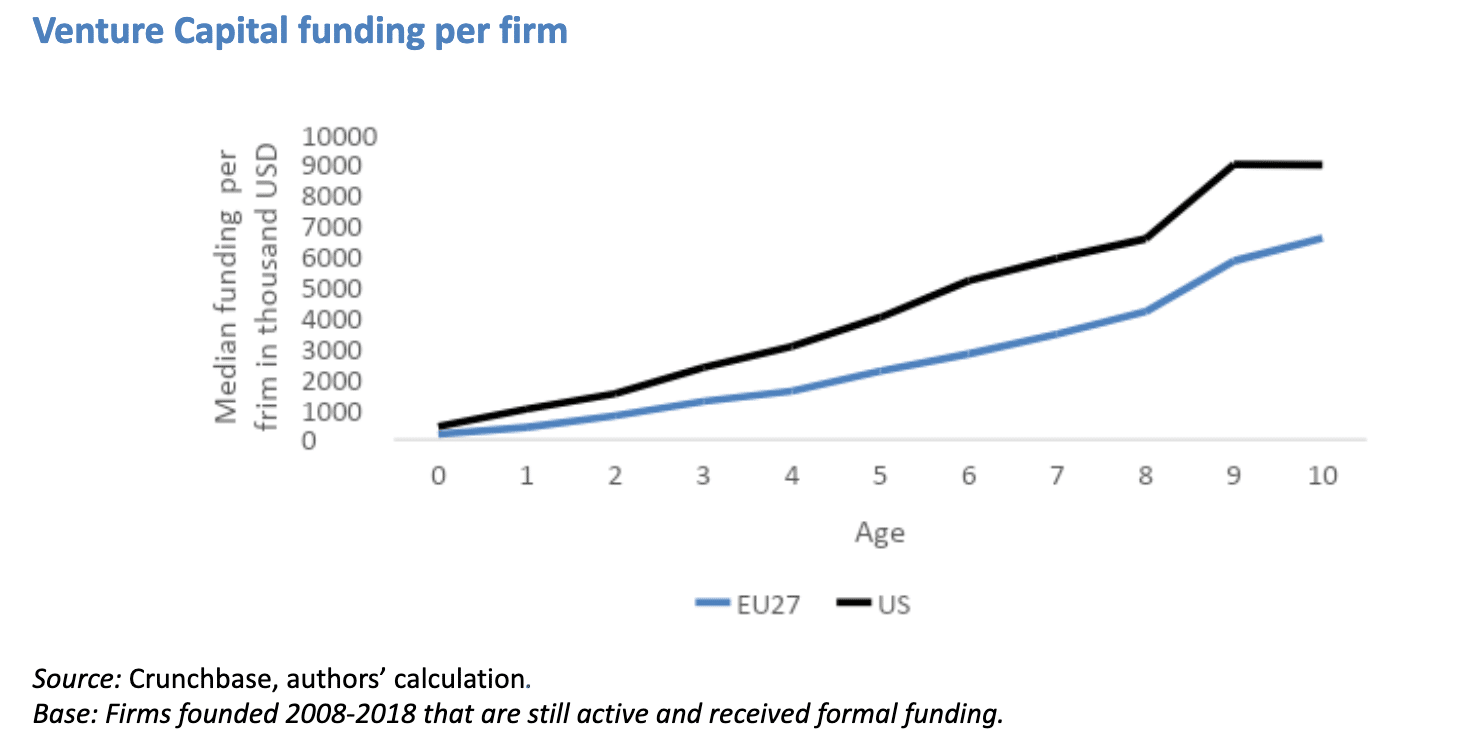

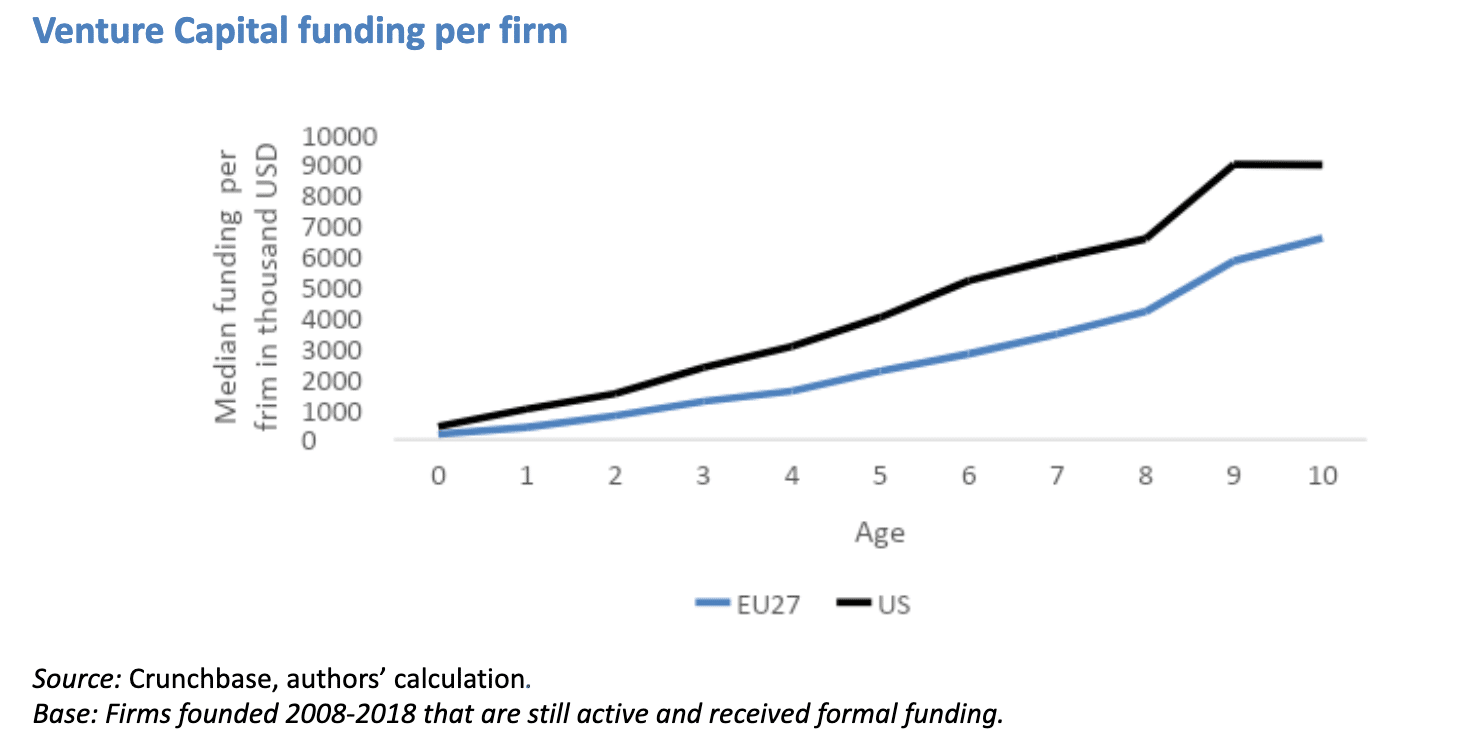

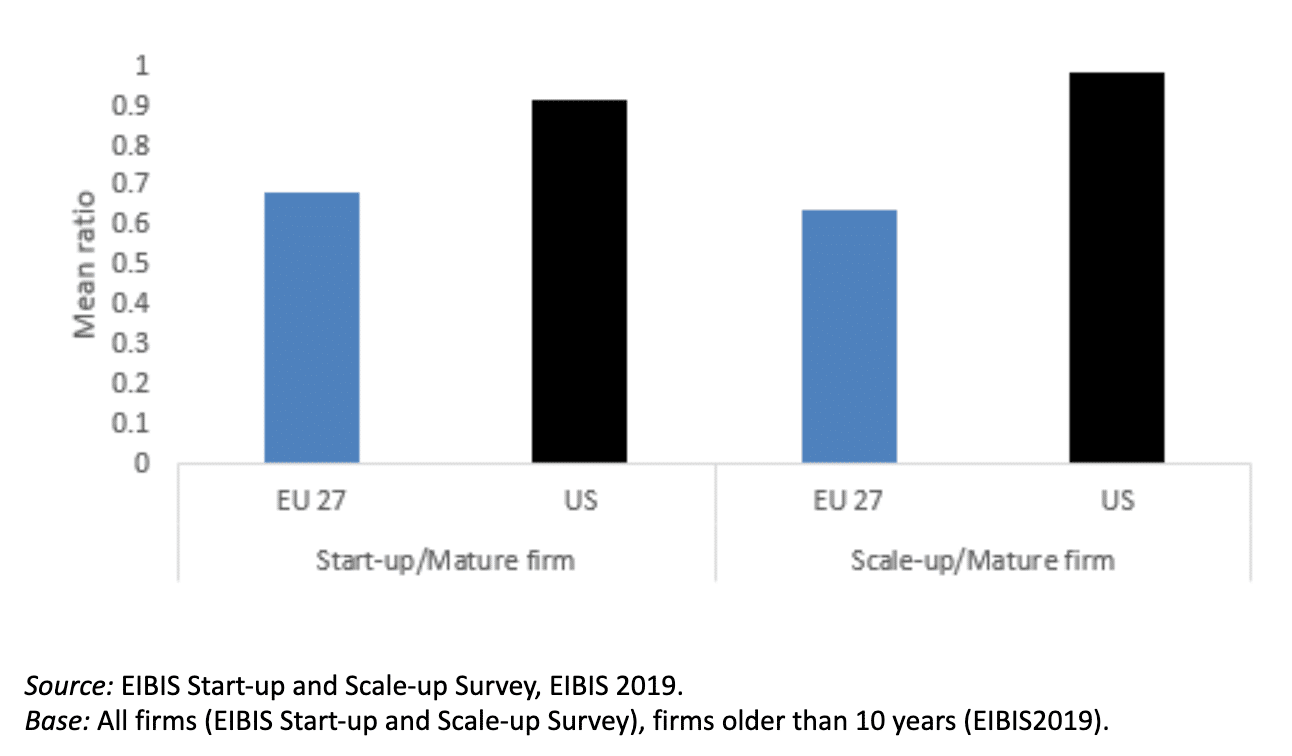

While EU and US start-ups are, on average, relatively similar in size, US scale-ups tend to grow much bigger than their EU peers. While initially the differences in startup-up funding between the EU and the US are modest, as firms grow older the gap between the EU and the US increases. The same phenomenon can be observed for firm valuations which, in turn, helps to explain the disproportionately larger share of unicorns.

Structural factors can explain some of the qualitative differences

The qualitative differences between EU and US scale-ups can, to some extent, be explained by structural factors. In particular, market size, access to top talent, as well as a relatively weak venture capital market all pose obstacles to stronger growth in Europe. The absence of a truly single market is an issue for firms in the EU27, in particular at later stages. Availability of finance is another one. Moreover, ‘Lack of staff with the right skills’ is an important obstacle to growth among scale-ups. 66% of start-ups and 72% of scale-ups report this as an issue in the EU27. Lack of employer attractiveness makes it particularly difficult for EU firms to attract top talent. For example, EU start-ups and scale-ups pay significantly lower wages than their US peers. That is true both in absolute terms as well as share of what more mature firms pay.

Structural weakness of the EU is perpetuated by lack of success stories

Past success stories play an enormous role when it comes to fuelling exit markets for new generations of start-ups, whether it be as acquirers of start-ups or through their impact on (stock) market liquidity. The difference in the acquisition activities of start-ups and scale-ups between the European Union and the United States is striking. Since 2012, US corporates have spent about EUR 500 billion on such acquisitions; their EU counterparts have spent about just one tenth of this amount (i.e. EUR 50 billion).

What can policy do?

While it is not too late, Europe needs to awake to the potential that start-ups and scale-ups bring with them. Our results suggest that to effectively promote start-up and scale-up activities, policymakers should complement structural policies aimed at creating a truly single market, closing the later stage funding gap, and reducing regulatory complexities. Special attention should be given to female entrepreneurs. We presented evidence that women-founded companies are not just under-represented in Europe, but also that they are often at a clear dis-advantage vis-à-vis their male peers, in particular when it comes to accessing growth financing.

Read the full EIB Investment Report here and explore all the findings on start-ups in Chapter 7:

https://www.eib.org/en/about/economic-research/eib-investment-report.htm