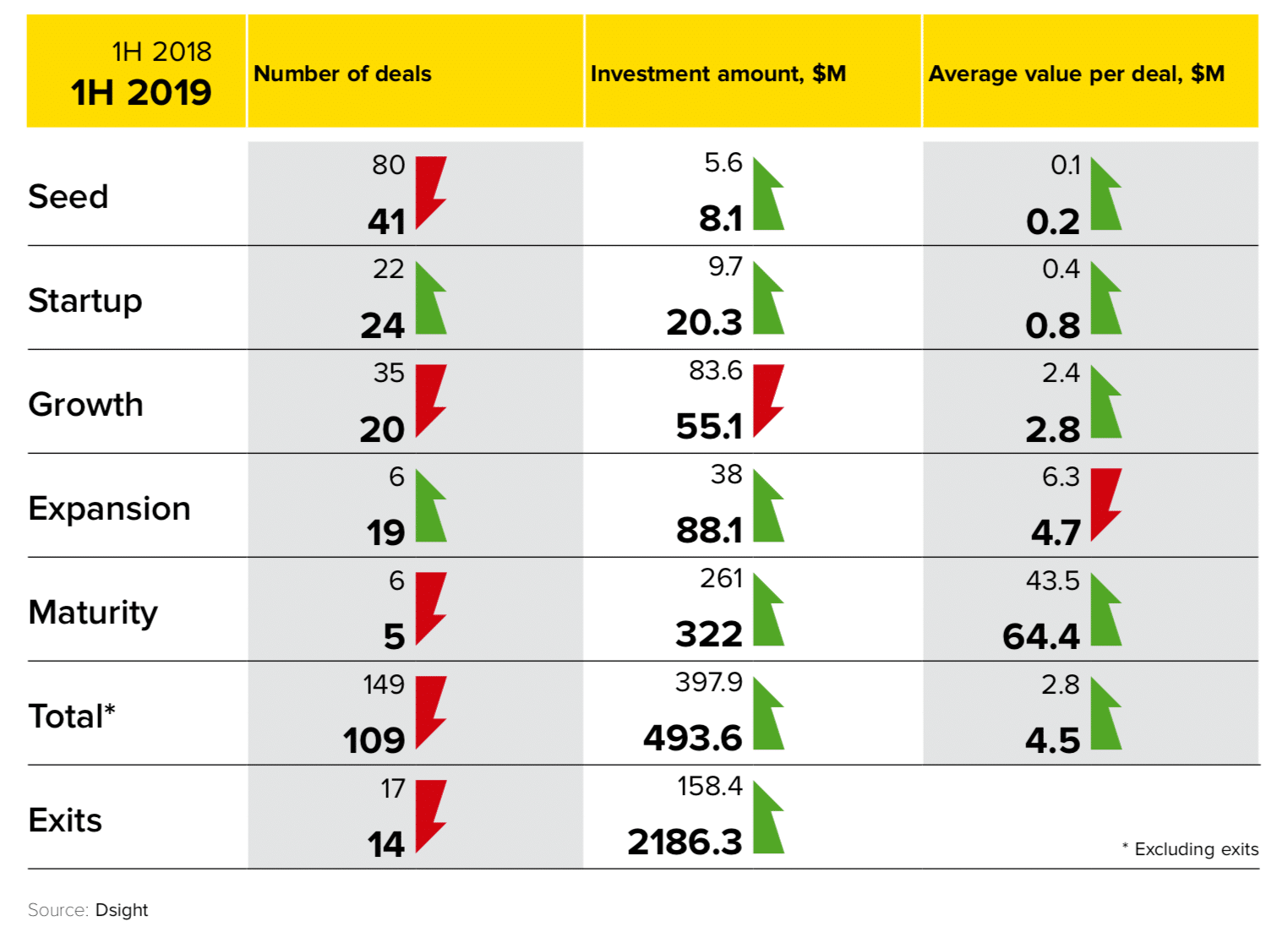

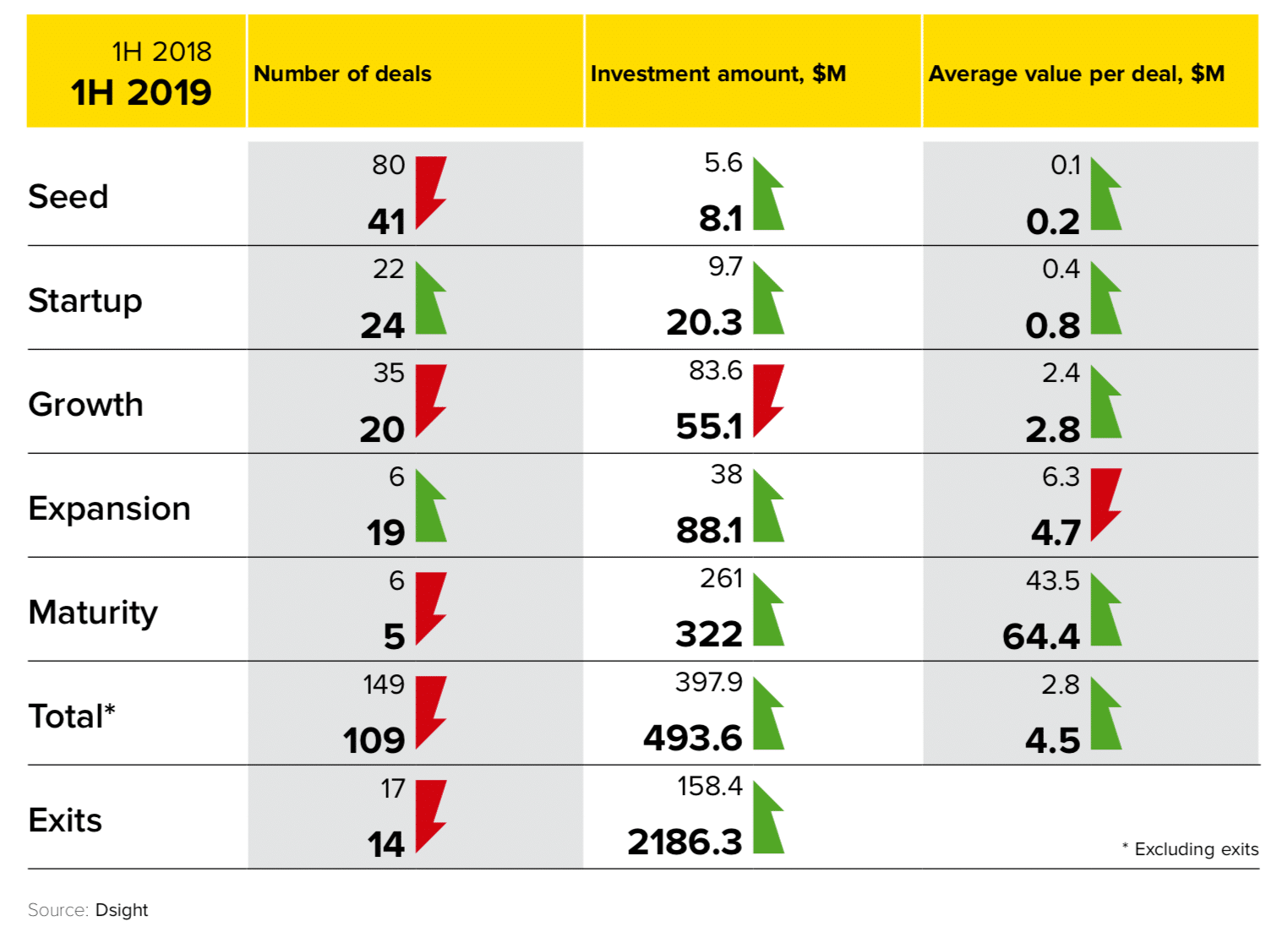

With contribution from Crunchbase, Dsight published Venture Russia 1H2019, covering venture activity during the first half of 2019. Research found that transactions on the Russian venture market were slightly lower in number than the first six months of the previous year, but higher in volume.

Russian venture dollars on the rise

Another six months are over, and despite woeful forecasts, Russia’s VC market is still far from moribund. We all recall an army of experts airing near-cataclysmic scenarios in which government sway in the market threatened to irretrievably dispirit real entrepreneurs. What we can see today appears to move the other way. New funds get started, private next to government. Russian corporations have set their sights on digital, investing in startups and integrating their solutions. The market is not awash in institutional investors yet, but already we are witnessing a rise in corporate customers, which fuels hope.

Of course, the government is not waiting in the wings; it voices plans to flood the market across segments with state largess via funds, grants, and procurement programs for its digital economy project. VEB Innovations, RVC, and RDIF have announced an array of deals and new funds. Those promises appear to have electrified the market, instilling some interest.

We can see a slight decrease in the number of deals, but overall moneys go up, a trend we first noted last year. Exits are now on the rise. Furthermore, there have been sizable international deals involving Russian companies; Veeam’s investment from Insight Venture and Hh.ru’s IPO on Nasdaq was nothing short of jubilant for Russia’s entire technology community.

Venture trends in Russia

The following trends have solidified:

- Funds begin investing abroad, and startups seek inroads into foreign markets

- New dividend models and credit funds emerge, as investors lend money or give convertible loans with interest charged to ensure liquidity long before exit

- State funds are sprouting up; many have already been announced, and more are likely to fire up the media before the end of this year

- Policy aimed at supporting investment climate is hard to predict. Topnotch investors get jailed, and so do liberal officials, an environment that prompted Belousov, a well-known Russian VC, to coin a formula: 8 unsuccessful VC investments of budget funds = a total of 20 years behind bars

- The venture world is changing, and old-style funds have to extend their services lists to make money; just investing is not enough

- Growing investment platforms and syndications are gaining more ground for a large number of business angels and other small-scale investors

- Commercial bonds have been introduced, a new tool worthy of note which venture companies have begun to use to raise funding

In a nutshell: the VC market is picking up; and although foreign capital is not knocking on our door yet, expectations are guardedly optimistic.

Download the full report here.

About Dsight

Dsight is a business intelligence platform that includes databases (startups, investors, corporations, experts and events) and automated products for Technology Monitoring, Tech Scouting and Market/Startup Research in Russia and globally. The company is a data exchange partner in Russia for Crunchbase. Dsight publishes Venture Russia reports twice a year covering VC/Hi-Tech investment deals and trends in Russia. Arseniy Dabbakh and Sergei Kantcerov are founders of Dsight.