Digest Africa – provider of news, data, insights and analysis on the African startup ecosystem – is proud to announce a partnership with Crunchbase and to bring you our H1 report, breaking down highlights and funding trends on the continent for H1 2020. Our data collaboration with Crunchbase will result in more data-intensive reports and insights, tapping into the natural synergy between our two companies and multiple markets.

Funding for African Startups in H1 2020

The first half of 2020 has been a roller coaster for the continent of Africa. For funding raised, H1 2020 saw $370.5M across 149 rounds compared to $486M across 193 deals of H1 2019 – a significant drop of 24%. On a positive note, February 2020 recorded $124.7M across 34 deals, which is 226.4% more than $38.2M raised across 22 deals in February 2019.

The effects of the COVID-19 pandemic included a drop in funding for startups on the continent, as fundraising plans continue to be re-evaluated and business models tested. Most investors are cautious and continue to fund existing portfolio companies and sectors that are seeing upside from COVID-19 effects. Funding to women-led or women co-founded startups remains low at 13% of all funding raised.

Number of Deals: H1 2020 saw 149 deals take place, a decrease of 44 (22.8%) compared to H1 2019. This is a result of lower investor participation as investors are looking to invest in more established companies with more sturdy businesses that can weather the pandemic effects.

Total Funding: $370.5M of total funding was raised, which is a decrease of $115.5M (24%) compared to $486M raised in H1 2019. However, there was 226% more funding raised in February 2020 ($124.7M) than February 2019 ($38.2M). The largest round of the period was raised by South African-based Jumo – the startup raised $55M.

Funding Stages: The majority of startups raised Seed rounds (60 rounds amounting to $17M) with the largest deal being from South Africa’s Carry1st. This is unlike H1 2019 where the majority of startups raised Grants (114 rounds totaling $9M).

Diversity: Only 40 out of the 188 startups that raised funding in H1 2020 are co-founded by women, raising $47.53M in total. The largest deal was financial service Sendy’s $20M Series B backed by Atlantica Ventures, Toyota Tsusho Corporation, Asia Africa Investment & Consulting, and other investors.

Sectors & Countries

Industries: The Financial Services sector regained first place and secured the most funding during H1 2020 with $122M, after a temporary displacement in 2019 by Commercial & Professional Services (which got a big boost from Andela’s $100M raise). This was then followed by Healthcare & Pharma and the Transport & Logistics sectors with $88M and $56.5M respectively. These industries became global essential services and therefore thrived. The Travel & Leisure sector took a hard hit with only one raise for the period from Wantotrip in a $65K seed round.

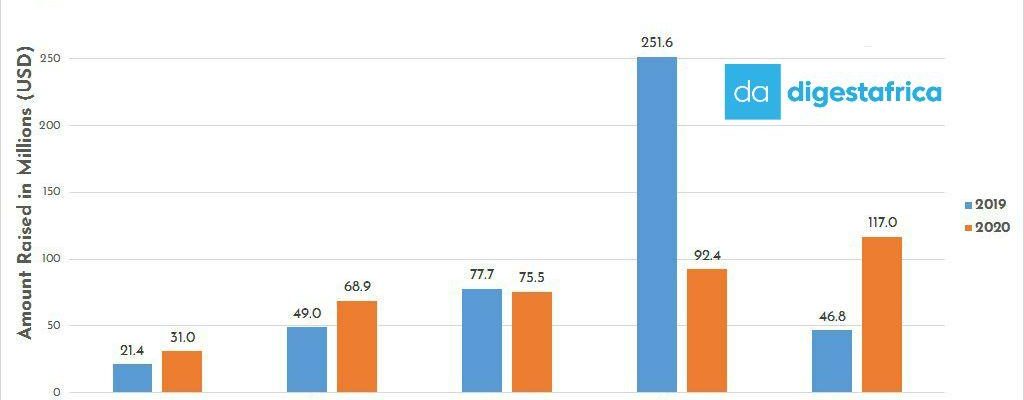

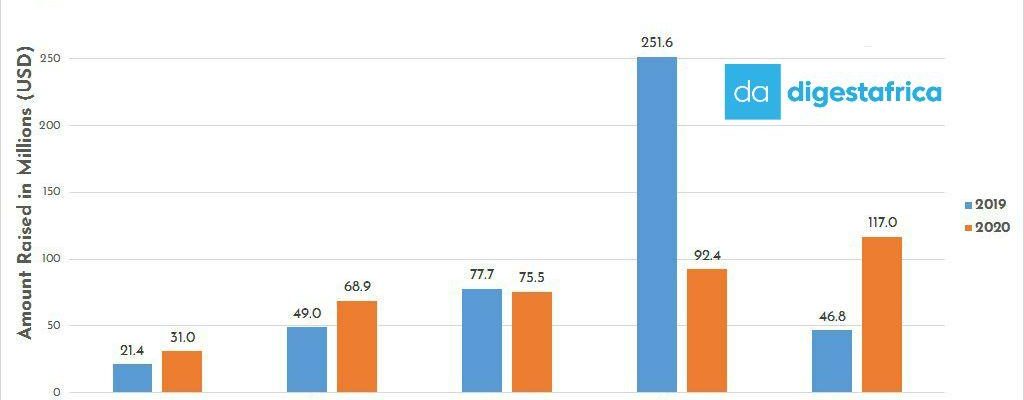

Countries: South Africa, Nigeria and Kenya continue to receive the lion’s share of total investment in Africa for another consecutive year, respectively securing 31.6%, 25% and 20% of funds raised in the period. Startups based in these countries raised $117M across 43 deals (South Africa), $92.4M across 48 deals (Nigeria) and $75.5M across 30 deals (Kenya). Previously, these countries were responsible for 9.6% (South Africa $46.8M), 52% (Nigeria $252M) and 16% (Kenya $78M) of total funding in 2019.

Investors, Funds, and Exits

Investors: Y Combinator invested in 12 Africa-based startups, making it the top investor of H1. MasterCard Foundation participated in 11 rounds. Other top investors based on the number of investments made for the half include: Founders Factory Africa (9 deals), Villgro Kenya (9 deals) Flat6Labs (8 deals) and Ventures Platform (7 deals).

Funds: $672M in total was raised across 7 funds by GPs, the largest fund being Accion Quona Inclusion Fund managed by Accion with additional investment from Quona Capital and other undisclosed LPs. Novastar Ventures also raised a hefty $108M for the Novastar Ventures Fund Africa II, followed by the $105M I&P Afrique Entrepreneurs 2 Fund by GP Investisseurs & Partenaires.

Exits: UK-based Circle Gas acquired Tanzanian KopaGas for $25M, the only disclosed acquisition for the month.

For more detailed analysis, read Digest Africa’s brief on H1 and access the full Digest Africa Index for H1 2020 here.