Crunchbase Spotlight is a series that celebrates diversity and inclusion in entrepreneurship, venture capital, and tech by profiling people of color, women, and individuals who identify as LGBTQ.

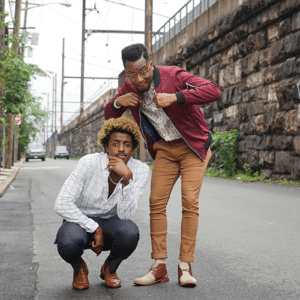

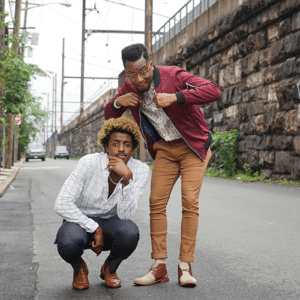

Meet Ivan Alo and LaDante McMillon, the Co-founders of New Age Capital, a venture capital firm investing in tech and tech-enabled startups founded and led by Black and Latine entrepreneurs.

The Early Days

Before joining forces to start New Age Capital, both Alo and McMillon came from humble beginnings.

Alo, who is of Liberian and Nigerian descent and migrated to the United States from France when he was three, showed entrepreneurial tendencies at a young age. As he mentioned during our conversation, “I was always entrepreneurial and obsessed with business and learning about enterprises and wealth creation at a young age. Through that, I ended up starting a couple of hustles in high school. Along with playing sports, I’d do things like sell snacks to teammates when we didn’t have vending machines or mixtapes from Limewire.”

Those entrepreneurial tendencies coupled with a growing interest in real estate investing as a wealth creation vehicle led Alo to attend Boston College where he studied finance – an area of focus he thought would help with real estate.

McMillon, on the other hand, was born in Arizona and grew up primarily in Philadelphia where his taste for filmmaking blossomed. This passion led him to Boston College where he studied communications. However, he soon realized that he didn’t want to go the Hollywood route. Instead, he launched his first business leveraging his love for filmmaking and storytelling. What was the business? Helping entrepreneurs tell their stories leveraging his skills in videography, photography, graphic design, and animation.

Working with entrepreneurs naturally led McMillon to the tech industry where he immersed himself in the local startup scene. This is the moment in time that sparked the creation of New Age Capital. As McMillon explained it, “I was going to tech meetups, talking to founders and helping them think through their strategies in terms of marketing. Ivan would tag along with me. Eventually, that would lead us to having conversations with founder after founder and developing a passion for their business strategies – essentially helping them build companies. This was the early stages of New Age Capital.”

The Genesis of New Age Capital

As Alo and McMillon got more immersed in advising founders, they became passionate about building a product themselves after working with one founder in particular. In late 2014, they decided to take their passion for financial literacy, which they weren’t exposed to growing up, and launched LionShare – a social network based around financial education. Through their struggles of being first time, non-technical founders with much to learn and a long startup journey ahead, they humbly agreed to put LionShare to bed at the end of 2015.

At the same time they continued to increasingly advise founders, particularly founders of color, and their growing passion for this came to a head in 2016 when they officially launched New Age Capital and embarked on their venture capital journey – all while having full-time jobs.

What’s refreshing about Alo and McMillon is that they don’t have a traditional VC or tech background beyond McMillon working with startups. They didn’t work at Silicon Valley tech companies or any other financial institution that invests in companies. As Alo put is, “We never wanted to get into venture capital. It wasn’t a dream. We didn’t know much about the industry five to six years ago.”

What sparked the New Age Capital founders to get into the venture capital industry was a combination of several things:

- Noticing a glaring problem (lack of funding going to entrepreneurs of color)

- Realizing they were equipped to solve the problem

- A passion for helping entrepreneurs build businesses

Despite not having prior venture capital experience, Alo and McMillon approached their new venture with an eagerness to learn. As McMillon shared, “There were a lot of things we just didn’t know – the dynamics of funding, dynamics of raising a fund, investing in entrepreneurs, how entrepreneurs go about raising funds for their companies. These are the kinds of things we continually learned from veteran venture capitalists and entrepreneurs and taught ourselves by reading books, blogs, watching video content and listening to as many podcasts as possible.”

Naturally, as newcomers to the venture capital world with no connections, the duo hit some roadblocks primarily around raising capital for a fund. As Alo explained it, “We realized we weren’t going to be able to raise a big fund out the gate” He continues “Venture capital is all about relationships.”

So, how does a new venture capital firm whose founders don’t have traditional venture capital backgrounds or established relationships with people with deep pockets get up and running? Enter Lightspeed Venture Partners.

Alo and McMillon developed a relationship with one of Lightspeed’s founding partners, Barry Eggers. Noticing the progress the New Age Capital team had made over the years, Eggers gave them an opportunity to become investment scouts for Lightspeed.

In essence, Lightspeed gave the duo capital to enable them to write $25K – $50K angel checks to start building their track record and in return bring promising companies to the Lightspeed portfolio. Alo adds more context, “We treated that relationship as if Lightspeed was our limited partner. So, writing investment memos, doing quarterly meetings with founders and Barry…in effect creating the cadence and infrastructure of fund managers. That has helped us evolve and given us a lot of the opportunities we have. We think moving forward this is going to help us raise a larger fund than the one we wanted to in the past.”

Thanks to Lightspeed’s support, New Age Capital has been able to employ their thesis and strategy of investing in Black and Latine founders with a portfolio of twelve companies across several industries.

Final Thoughts

While Alo and McMillon attended Boston College for different reasons, their friendship and passion for business brought them together to launch a mission-driven venture firm that’s tackling a big problem in the startup world: the lack of funding for companies led by people of color.

With the experience and knowledge they’ve acquired over the years, New Age Capital is well on its way.

Stay tuned for the next Crunchbase Spotlight.