America’s innovation sector is critical to regional and U.S. prosperity, but a recent Brookings report finds that five U.S. metro areas accounted for 90% of the nation’s innovation-sector growth between 2005 and 2017. Young, technology-driven startups are a critical driver of the innovation sector. However, understanding how local economies are positioned within the innovation economy is bedeviled by outdated industry classifications, multi-year lags, and comparable, standardized data.

Startup Complexity Index

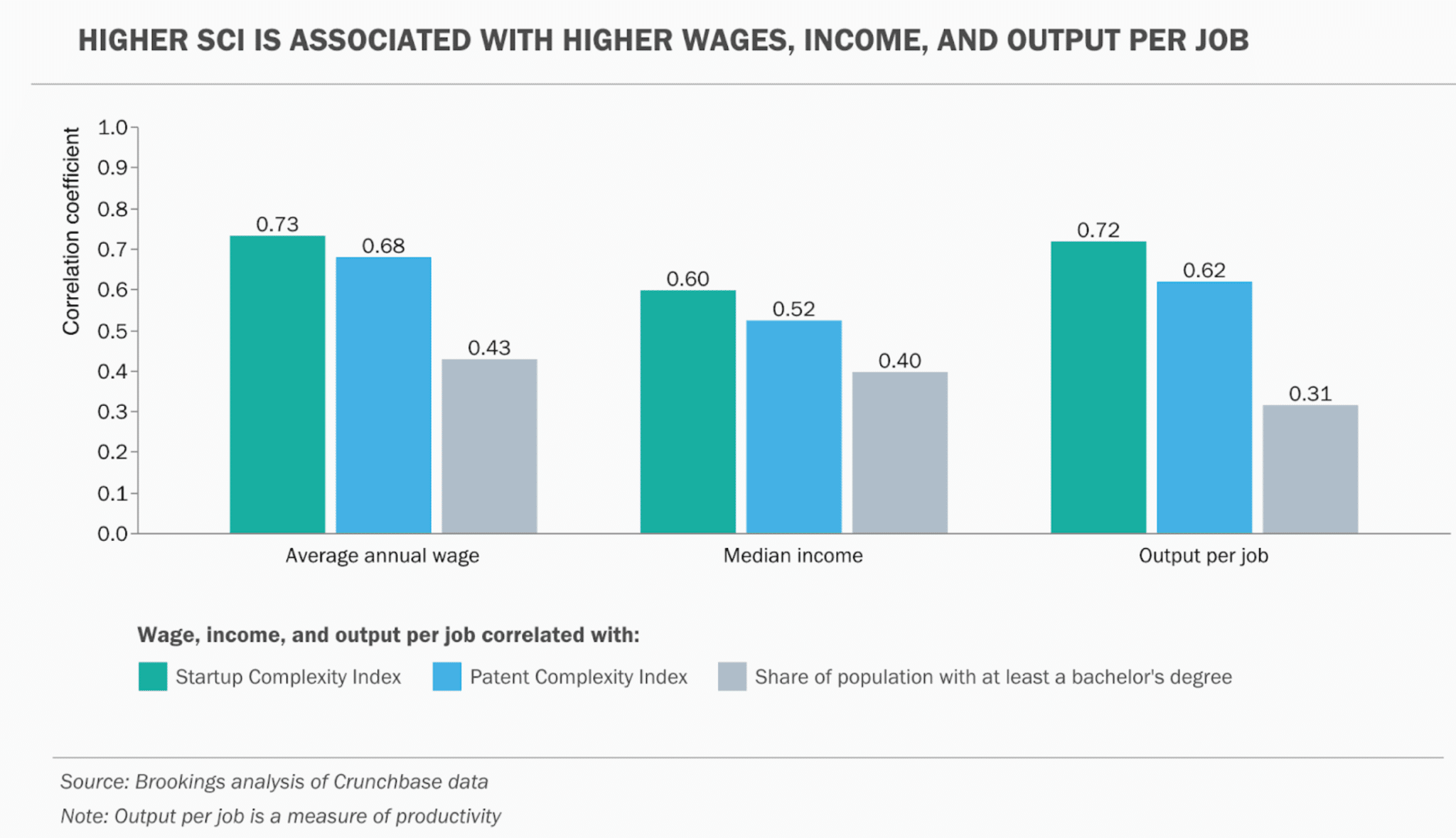

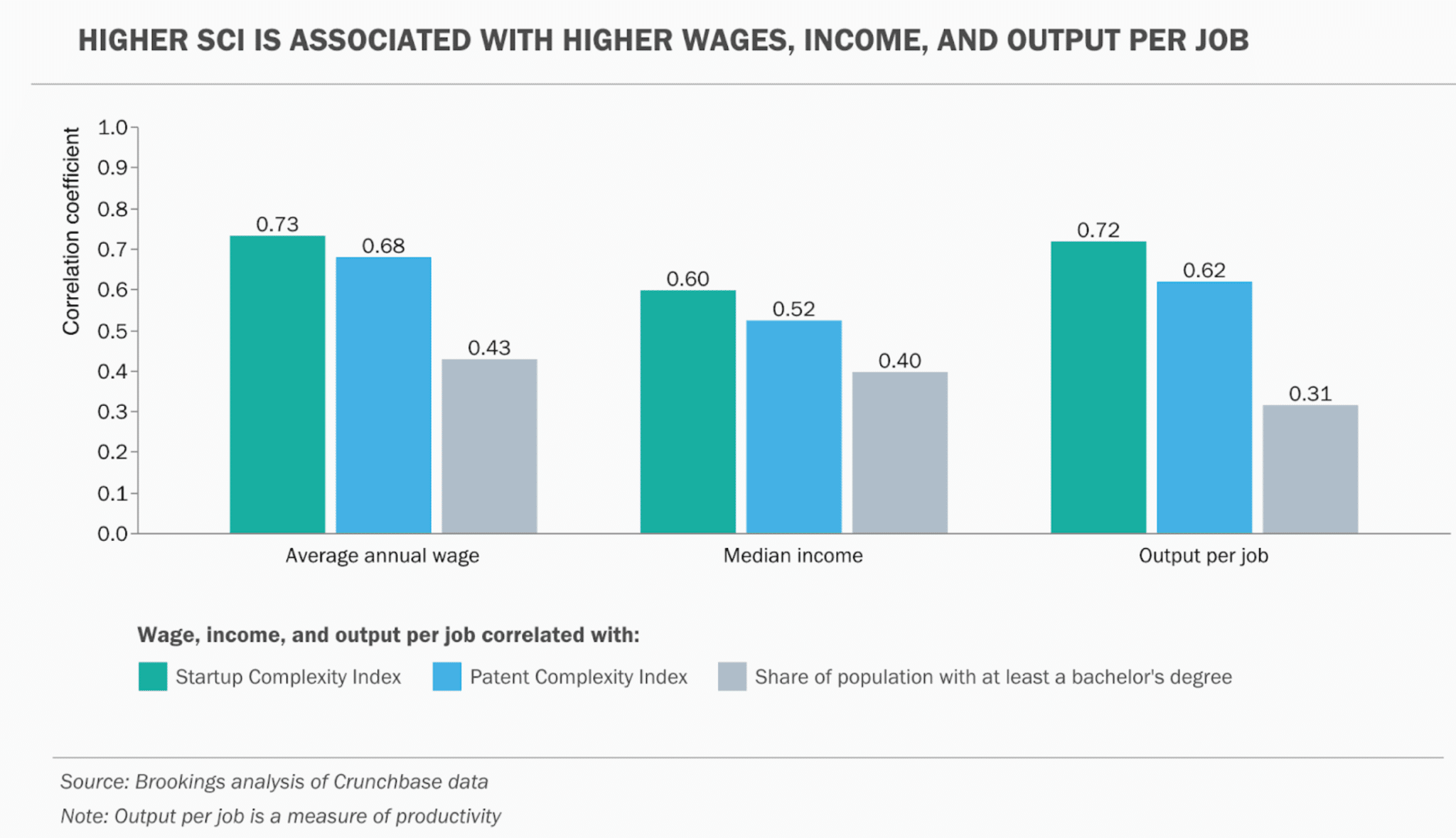

Recently we published a new report measuring and comparing the “economic development frontier” of U.S. metropolitan areas. To do this, we constructed a new Startup Complexity Index (SCI) with young innovative firms identified through Crunchbase. The SCI, even compared to traditional measures of innovation, is a stronger correlate of wages, household incomes, and productivity (Chart 1). This demonstrates the possibility of using Crunchbase data to complement mainstream datasets with real-time information organized in technology industries that better reflect the modern economy.

Our SCI combines metrics of startup diversity and startup ubiquity. Startup diversity refers to the number of technological industries in which a metro area’s startups exhibit advantage, or a higher-than-average propensity to innovate. Of the 99 metro areas we analyzed, San Francisco has the highest startup diversity, registering an advantage in 288 technology industries. By contrast, 15 metro areas have an advantage in just one technology industry.

Startup ubiquity refers to the total number of metro areas that have an advantage in the technology industry. Crunchbase’s broadest technology industries such as software, health care, and information technology are the most ubiquitous. The least ubiquitous industries include enterprise resource planning, podcasts, and fleet management, among others. The SCI therefore captures the complexity of startup ecosystem based on the interaction between diversity and ubiquity.

Although coverage error and sampling bias can exist in crowdsourced datasets, the benefits of having more up-to-date information at a granular level have strong practical applications for understanding local technological strengths relative to other regions. For instance, using these datasets, leaders in the San Diego region can not only say they are a “biotechnology hub” but specifically cite that San Diego has the 2nd highest concentration of biotechnology startups in the nation (after Boston).

Looking ahead

In subsequent analysis, we hope to leverage data from platforms like Crunchbase combined with official industry and patent statistics to offer a more complete view of local economic development frontiers at different levels of geographies and help leaders better understand their relative strengths in the innovation economy.

Sifan Liu and Joseph Parilla conduct research for the Metropolitan Policy Program at the Brookings Institution. The mission of the Metropolitan Policy Program is to deliver research and solutions that help metropolitan leaders build an advanced economy that works for all.