The crypto and blockchain community will remember 2018 largely for the bear market that saw bitcoin drop over 70% in value and an overall market decrease that surpassed 85%. Yet, the transition from bull to bear did also have positive implications. For example, in the first 3 quarters of 2018, VC investment in blockchain was up over 280% compared to 2017.

Discover industry trends with Crunchbase Pro.

Additionally, the role and position of the blockchain technology sector as an area of interest has increased significantly. In a recent poll of seed stage funds active in Israel, led by Ground Up Ventures, 65% claimed to be actively looking for investments or already invested in companies in the space. The same report showed the same number of investments were made in blockchain-based technologies as in those focused on retail or property tech. So while crypto markets at large saw a decrease in support, the wider sector continued to grow.

Blockchain keeps growing

The growth is supported by the active attention being paid to it by top global funds like Andreessen Horowitz, Bessemer Venture Partners, and even Kleiner Perkins, with the latter launching their own project. But even more interesting are the types of investments they are making.

We analyzed some of the top VCs based on data from Crunchbase and produced the following breakdown:

- Over 60% of the investments are goings to products – whether B2B or B2C – built on top of blockchain protocols

- Nearly 20% of investments are in protocols or infrastructure

- Just under 10% of investments in exchanges

- The remaining 10% invested in stable coins

The critical takeaway here is that a maturing technology landscape is leading to a more forward-thinking investment environment. In short, top visionaries in tech are looking for the next wave of blockchain innovation – game-changing applications and solutions.

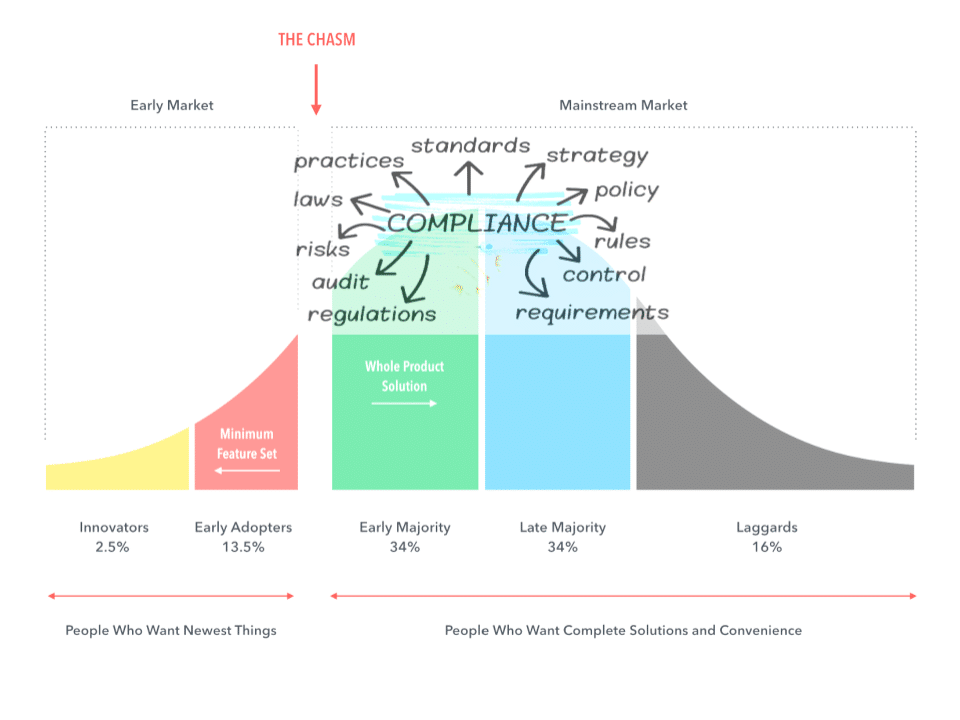

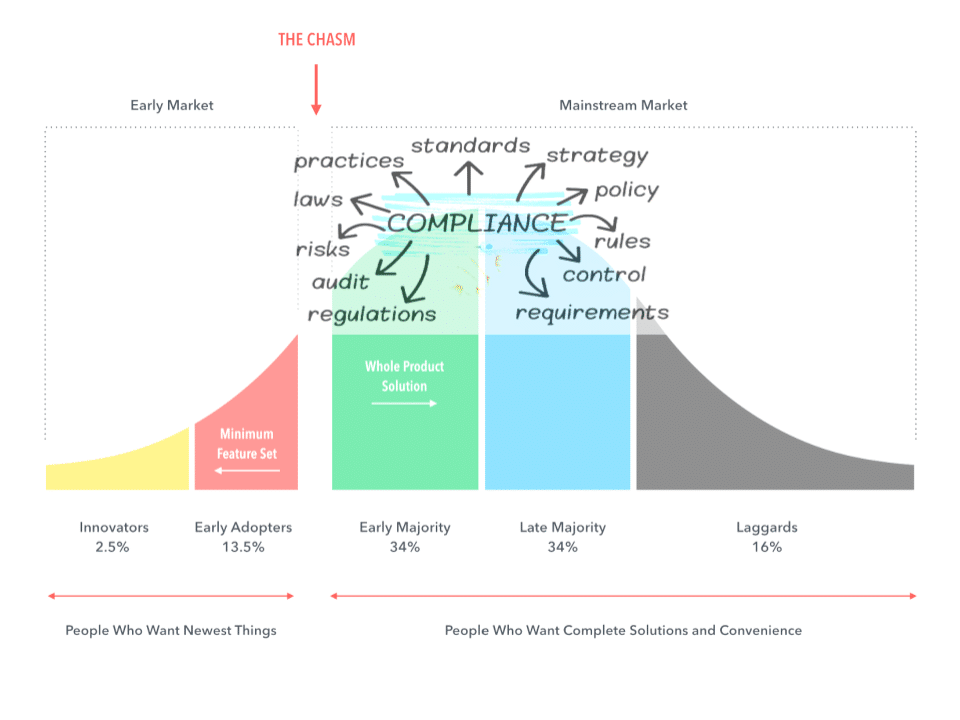

Photo source: Blockchain 2019: Making Sense of Uncertainty in the Regulatory and Compliance Landscape

3 big trends in blockchain in 2019

So what can 2019 bring for blockchain?

Blockchain trend: the rise of usage

The holy grail for blockchain to hit its inevitable (or unreachable, depending on your perspective) tipping point is large scale usage. If consumers and businesses are actually using the technology daily, it will answer the major question of the technology’s usability. It will also remove the ‘is blockchain the next big thing’ questions? This will enable companies, consumers and investors alike to focus on the actual problems that need solving as opposed to overarching questions.

If the trend continues, investment in practical blockchain-based solutions should also speed up the implementation process. The input of some of the top tech investors, the growing maturity of infrastructure, and the increasingly targeted focus of applications should drive real adoption in 2019.

Blockchain trend: vertical focus

As traditional goals and tech voices grow their influence the sector, expect startups to increasingly channel lessons from the “old world.”

Classic strategies, like targeting specific industries should come in vogue. We will see these strategies take place, even if it is just an initial tactic to drive growth.

General-purpose protocols and infrastructure players drove the early rise of technology in blockchain with wide audiences. However, as the industry matures, the ability to target specific, industry-prevalent problems will take hold.

Blockchain trend: an increase in corporate capital

The rise of better targeting and more mature infrastructure should push major corporations to increase their stake in the sector. The way companies like these invest, build products and expand their impact dovetails perfectly with the current status of the industry. As projects align with classic goals expect greater levels of investment and focus in solutions that could fit within wider projects these companies are leading or increase their influence in the long term growth of the sector.

These blockchain trends could help align goals that are currently misaligned for most companies in the sector. Blockchain’s long term goals must be aligned with practical business needs. To drive adoption and make these goals a reality we must balance decentralization, public blockchains with a business initiative.

Uriel Peled is the Co-Founder of Orbs, the hybrid blockchain and leads the company’s business development efforts globally. Prior to Orbs, Peled co-founded Visualead, a leading VR startup acquired by Alibaba.