We just released Harlem Capital’s 2022 Diverse Founder Report in partnership with Crunchbase for the second year in a row. We’re proud to note the history of this report.

In 2017, HCP started compiling a list of Black and Latine founders who had raised $1 million of VC funding as there wasn’t any aggregated list online. We wanted to know who the top diverse founders were given they were the founders HCP wanted to serve. So, we started pooling data from all over the internet.

Then, we started raising for Fund I in 2018 and limited partners kept asking, “But are there enough Black and Latine founders to have a diversity thesis for Harlem Capital?” Now, this was more than just curiosity as HCP had to prove we could find diverse founders across the country in which to invest. So we doubled down and made the research into a formal report produced by HCP.

What’s new?

This is our second report collaborating with Crunchbase. This year, the report expanded from 870 companies to 1,128 companies that have raised $1 million-plus. We also now show top industries by year to see which sectors diverse founders are building in most over time. Lastly, we have incorporated founder and investor spotlights from Esusu Financial, Lightspeed Venture Partners, Ulu Ventures and Kapor Capital, all of which have had a meaningful impact on the diversity within VC and startup ecosystems.

The 1,128 companies raised $43.7 billion of capital with a median raise of $6 million. Total capital raised decreased from $10.3 billion in 2021 to $4.4 billion in 2022, split equally between Black and Latine founders, a difference from last year where Latine founders raised 64% of total capital raised by Black and Latine founders.

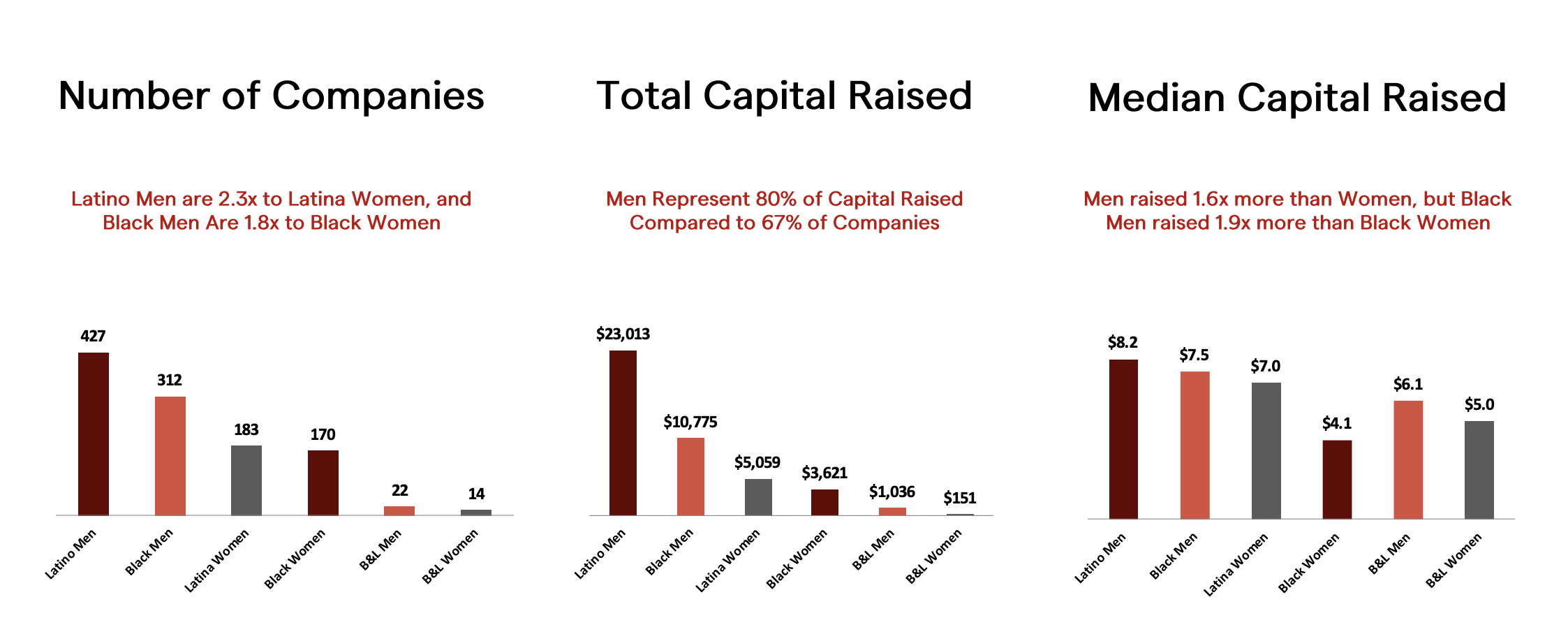

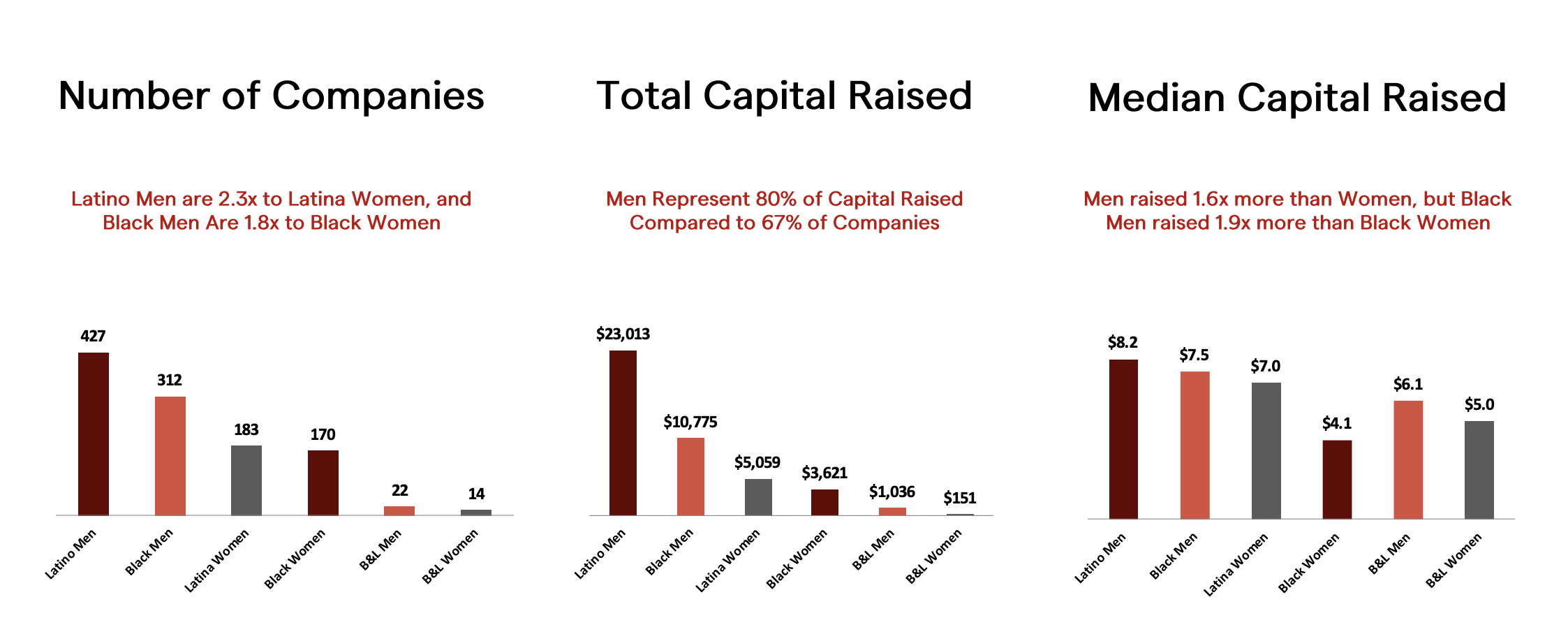

Who are the founders by gender and race?

Out of the 1,128 companies, 33% are women founders and 67% are men. However, women only received 20% of total capital raised, unchanged year over year. In terms of median capital raised, men raised 1.6x more than women. Black men have raised 1.9x more than Black women, and Latino men have raised 1.2x more than Latina women. Latino men continued to have the highest median raise of $8.2 million vs. $7.5 million in 2021.

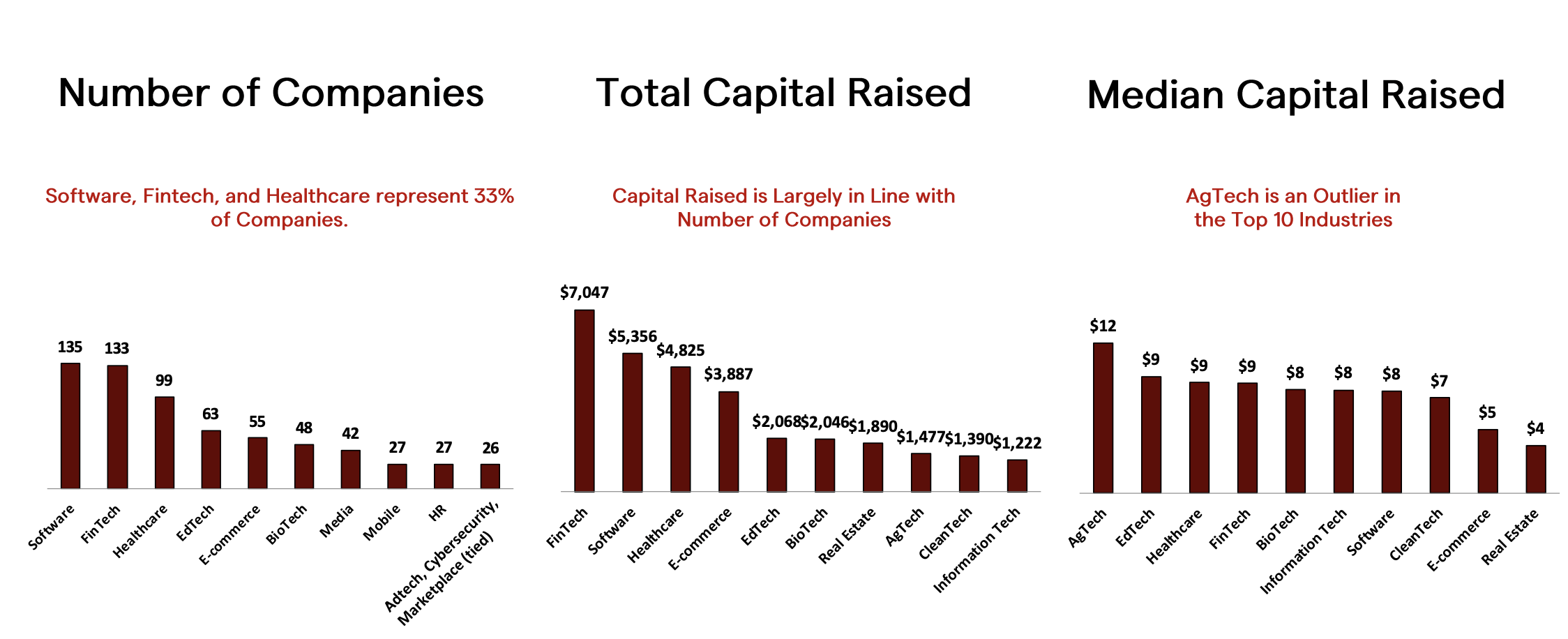

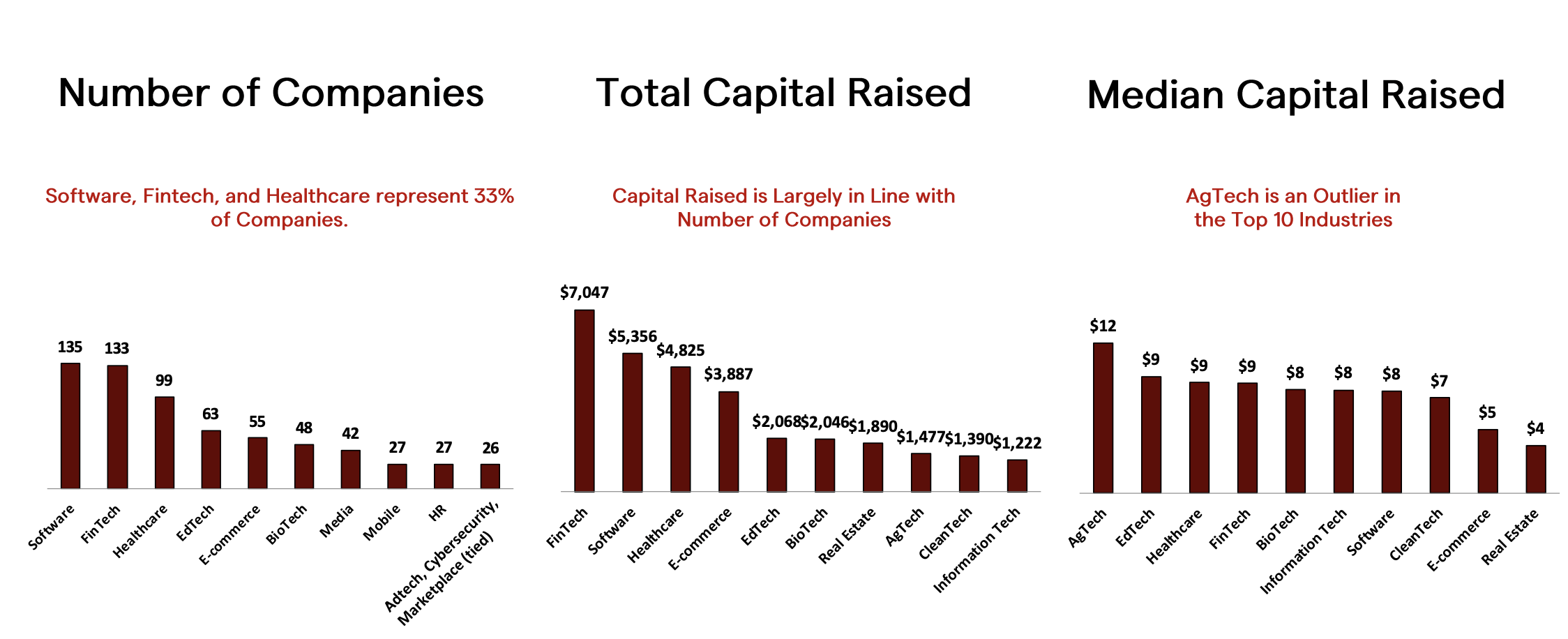

What industries are they in?

This year’s top industries continue to be software, fintech and health care, representing 33% of all companies founded. The top industries by raise amount are also fintech, health care and software, totaling $17.2 billion of capital raised. Agtech has the highest median raise. Top industries have remained relatively the same since last year, with the exception of cybersecurity and marketplace entering the top.

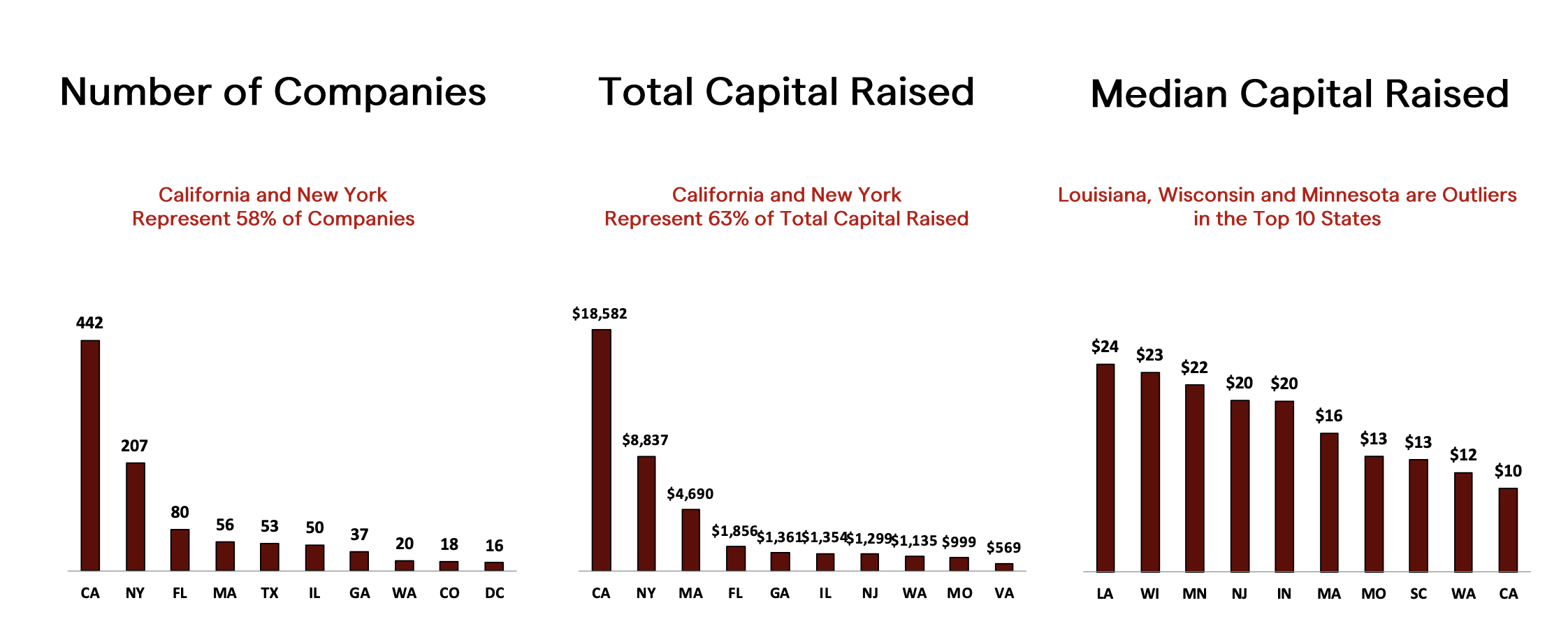

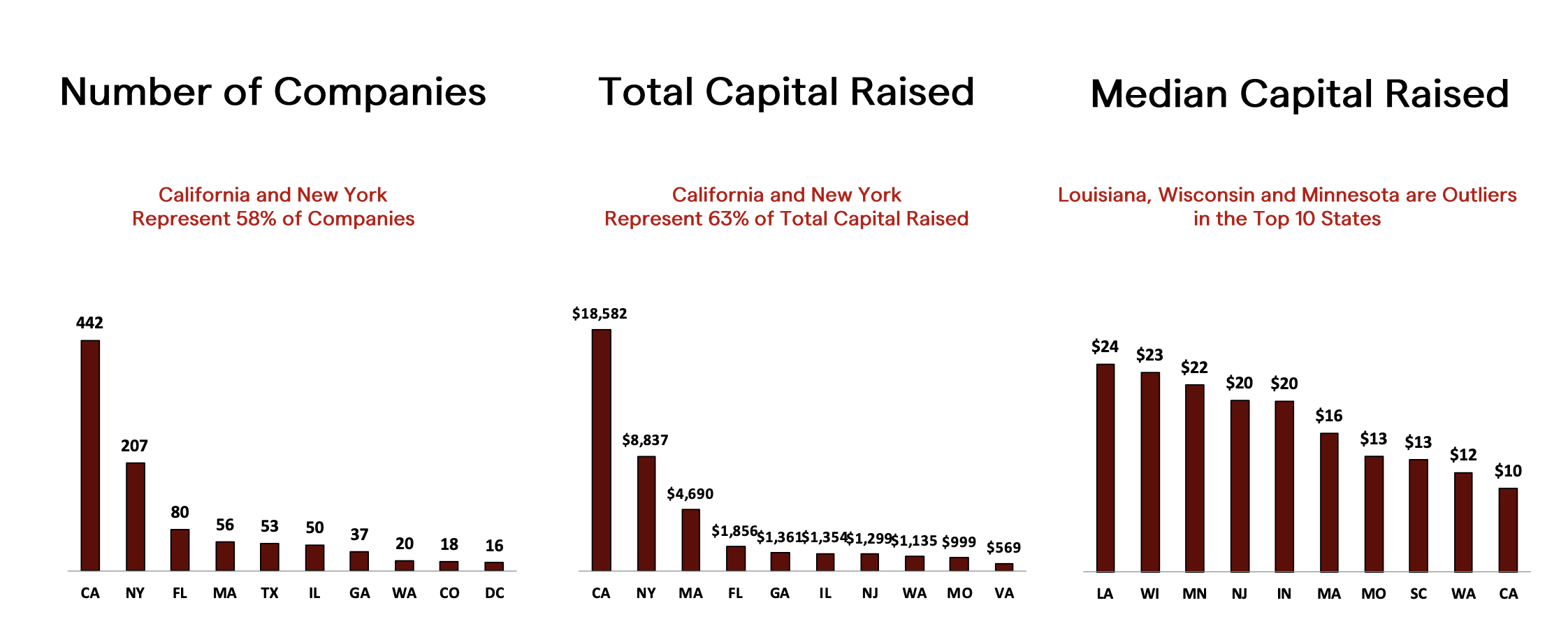

Where are these companies headquartered?

Similar to the overall venture landscape, 58% of company headquarters are in California and New York. However, California and New York represent 63% of funding, with California-based companies representing 43% of total funding. There is, however, still a large concentration of founders in Florida. Companies in Louisiana, Wisconsin and Minnesota have the highest median raises of between $22 million and $24 million.

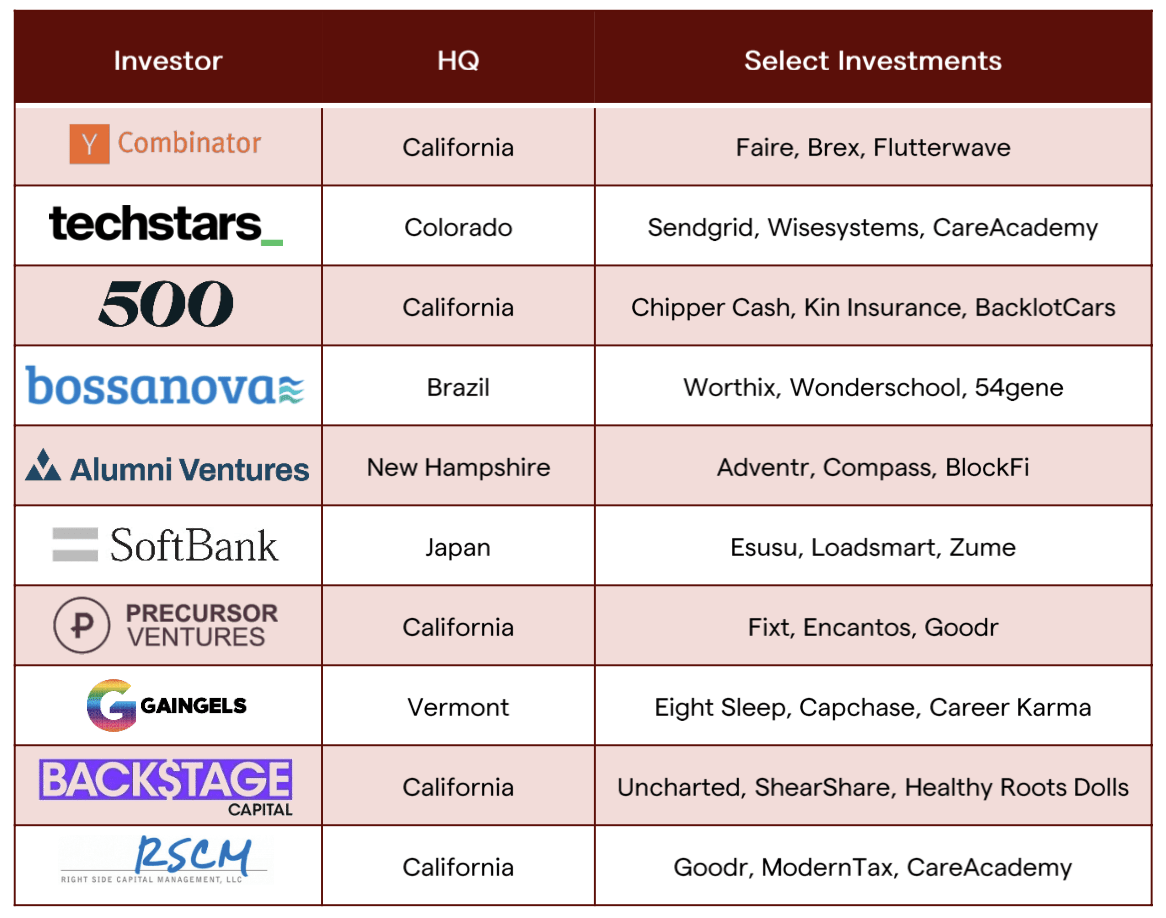

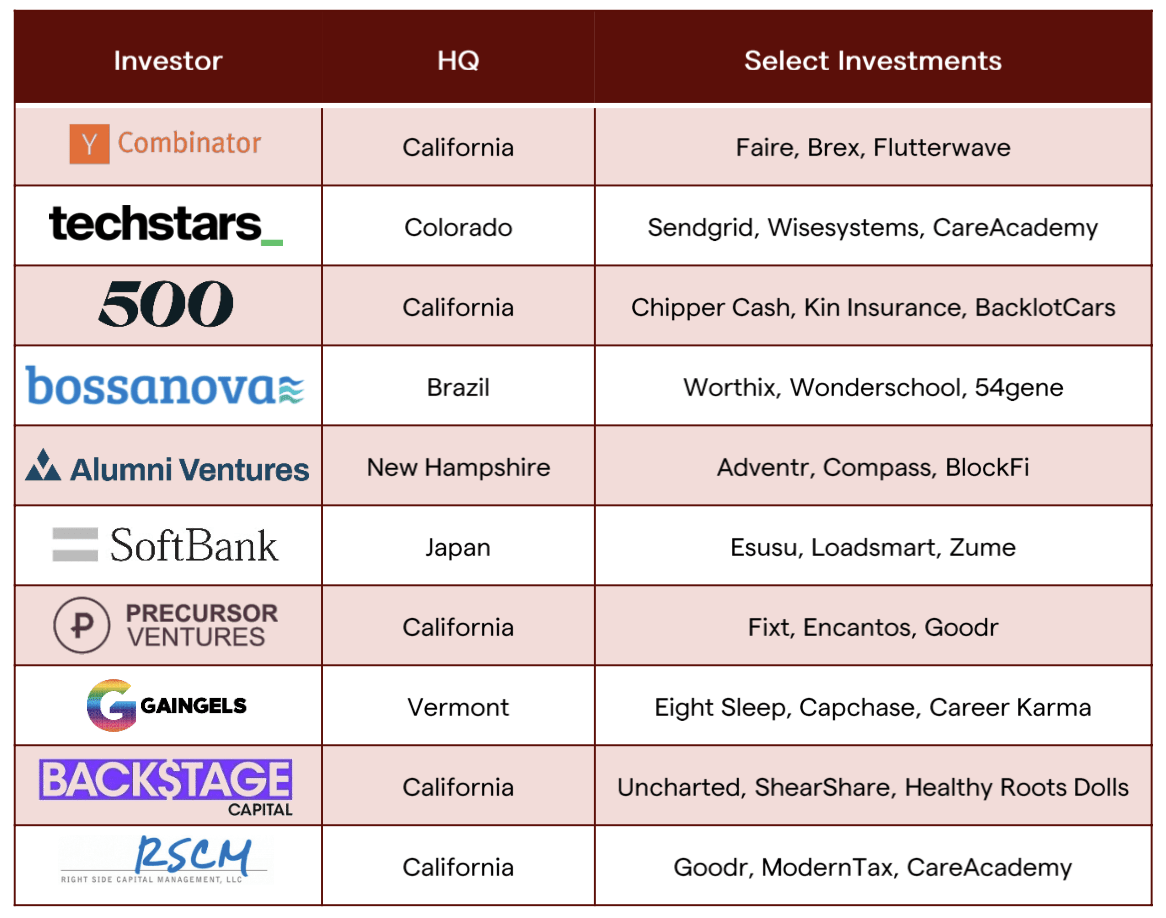

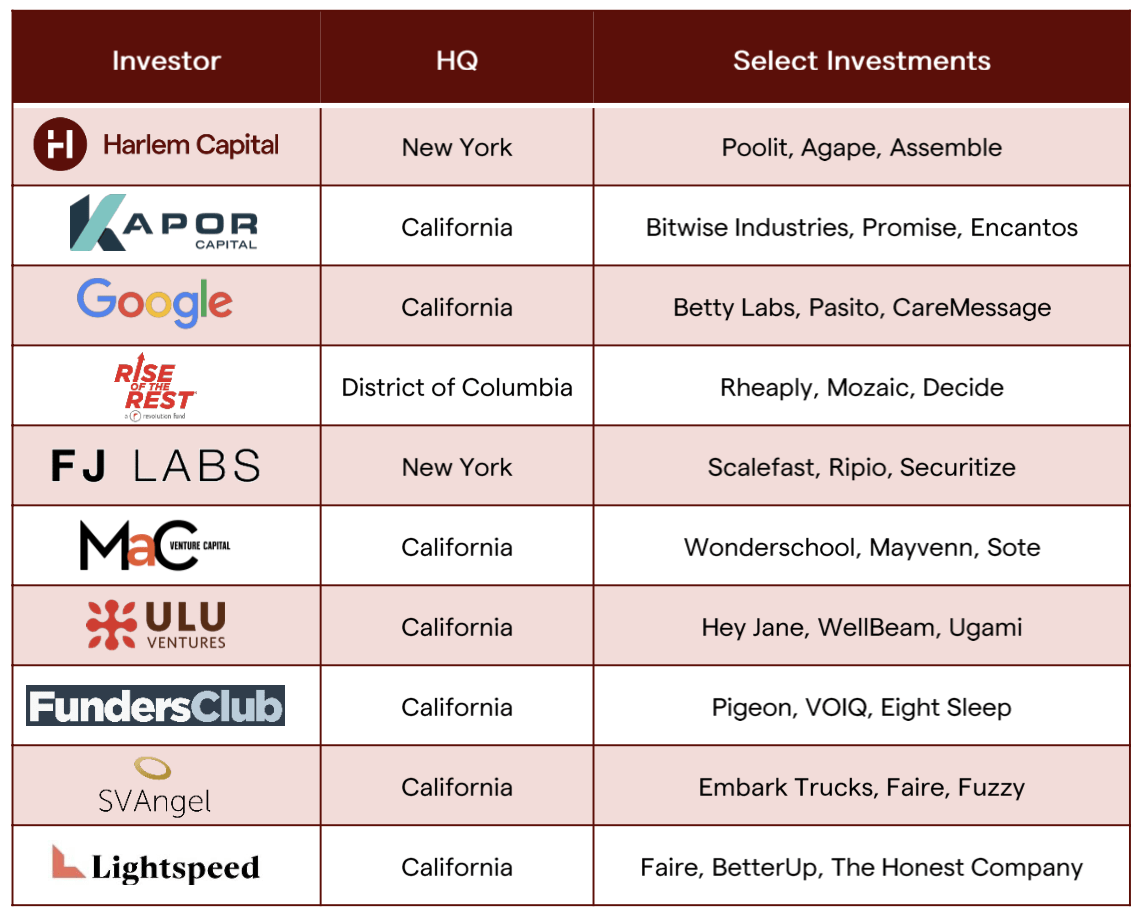

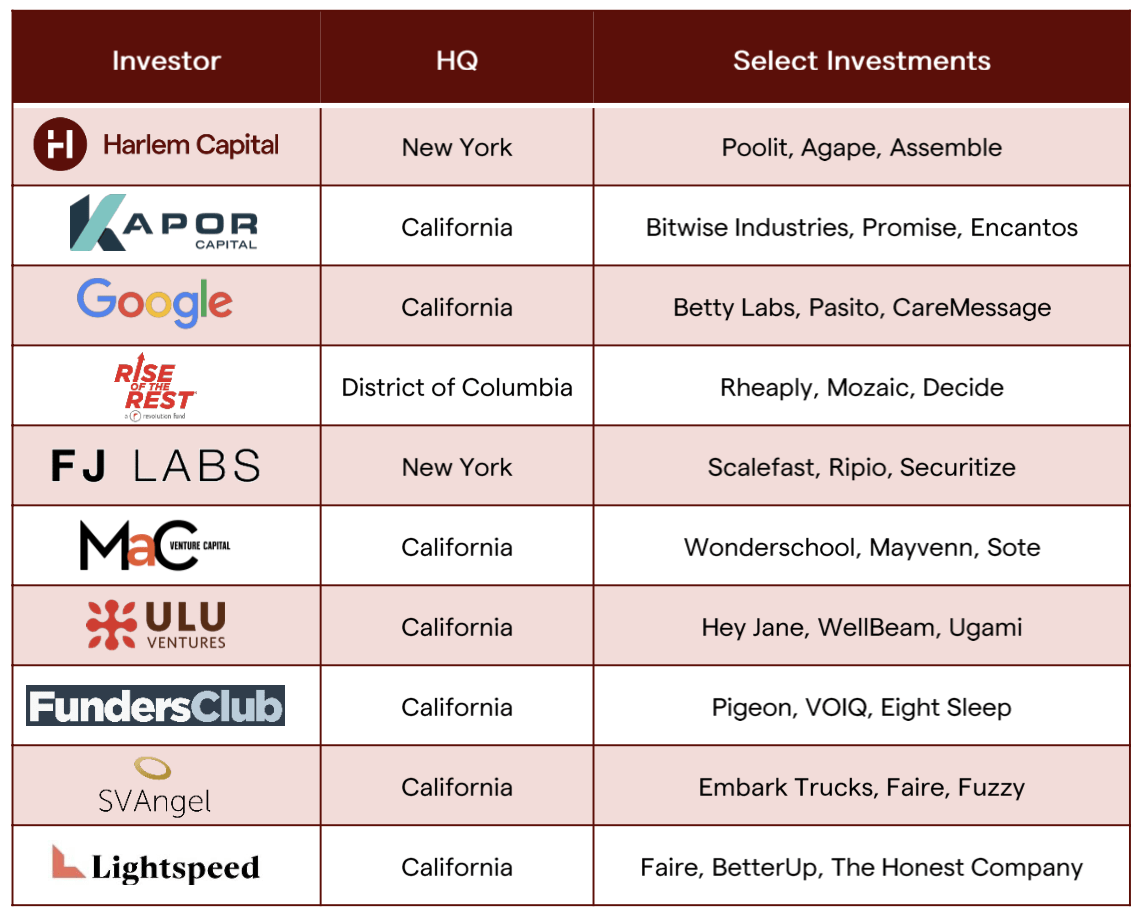

Who are their investors?

Our report includes over 5,000 investors across the 1,128 companies. Leading the pack are 20 investors who have made 25-plus investments and represent 864 investments total. The list includes different types of VC funds including accelerators, diverse-led and diversity-focused funds, corporate venture arms, and more.

What are founders and investors saying?

This year we had the pleasure of including one unicorn founder and three investors in our report. We did this to supplement the quantitative data with some qualitative insights from those most tapped into the diversity ecosystem.

Wemimo Abbey, co-founder and co-CEO of Esusu, on raising capital:

“My co-founder and co-CEO, Samir Goel, and I spoke with over 300 investors before we got the first ‘yes.’ When we began fundraising efforts for Esusu, we solicited our family and friends on LinkedIn, a rookie move that unintentionally broke many rules and took us months to rectify. Entrepreneurship is rarely an easy journey, especially for minorities, and the archetype of an immigrant founder does not exist in people’s minds. I even testified before Congress on the challenges minority-owned firms face when seeking capital, emphasizing the importance of investing in diverse-owned fintechs.

When Samir and I finally closed our first contract, we were $100,000 in debt and couldn’t even afford a hotel room. In fact, we decided to crash at a Denny’s and work there through the night, but we eventually were kicked out. This experience and the many other challenges we’ve faced as diverse entrepreneurs keep us humble and grounded and remind us where we started at the beginning of the Esusu journey.”

Mercedes Bent, partner at Lightspeed Venture Partners, Nancy Torres, partner at Ulu Ventures, and Brian Dixon, managing partner at Kapor Capital, on the challenges of being VCs who invest in diverse founders, respectively:

“Silicon Valley likes to invest in founders that are “straight out of central casting” — the nerdy founder who’s been coding since they’re young, or that comes from an executive position at a top startup of the last decade. Many diverse founders don’t fit this narrative and it can be difficult as a VC to get other investors to see their merit if they don’t speak Silicon Valley’s dialect fluently. I try to overcome this bias by investing in founders with a really steep learning slope and undeniable energy.” — Mercedes, LSVP

“We often hear the claim that there’s a dearth of potentially “qualified” diverse VCs or entrepreneurs and that diversity requires “lower standards” in venture capital. Not only does research show that diverse teams have a 30% higher MOIC [multiple on invested capital] at exit on average, but we’ve seen throughout Ulu’s 15 years that companies with diverse founding teams financially outperform those without any gender or racial/ethnic diversity. Looking at our Funds I and II, we saw that investments with a diverse founder (woman, person of color or immigrant) generated approximately a 5x MOIC, double that of investments without any diversity on the founding team.” — Nancy, Ulu Ventures

“Defeating the bias that a diverse founder faces means concessionary return, we’ve proven this is not the case by releasing our returns for the first time in our 2019 and 2022 Impact Reports. [We overcome these challenges by] highlighting successful diverse founders and spreading the word about the importance of helping founders build diverse teams, which we’ve done since 2016 with our Founders Commitment. [There is also this] belief from other investors that diverse founders do not exist in certain sectors and are concentrated in only a few. [We overcome these challenges by] actively seeking out founders in those verticals and being proactive in facilitating intros for them to investors focused on those sectors.” — Brian, Kapor Capital

Conclusion

This year’s report included more data than ever. We are big believers in Data Drives Decisions, so this new data will hopefully help more funds find incredible founders as well as let more founders know they aren’t alone. There are now over 1,100 Black and Latine founders that have raised $1 million-plus of venture funding.

We didn’t have the data to prove our diversity thesis over five years ago, but now the data is more clear than ever. Despite the disproportionate decline in venture funding for Black and Latine founders in 2022, we are still in the early innings of what we believe is an asset class: diversity investing. These groups are still underfunded, especially Black women, yet they have still created $100 billion-plus in value. We also continue to believe that this list will represent $1 trillion-plus in value by 2030.

It is our mission at Harlem Capital to serve these founders at the earliest stages and we’re excited that we represent 35 companies on this list. Check out the 2022 Black & Latine Founder Report on airtable to see the full list of 1,128 companies.

This article is part of the Crunchbase Community Contributor Series. The author is an expert in their field and we are honored to feature and promote their contribution on the Crunchbase blog.

Please note that the author is not employed by Crunchbase and the opinions expressed in this article do not necessarily reflect official views or opinions of Crunchbase, Inc.