It’s easier than ever to start a business, but harder than ever to become the biggest, particularly when we talk about big tech companies.

Not only is it difficult, but it’s also expensive.

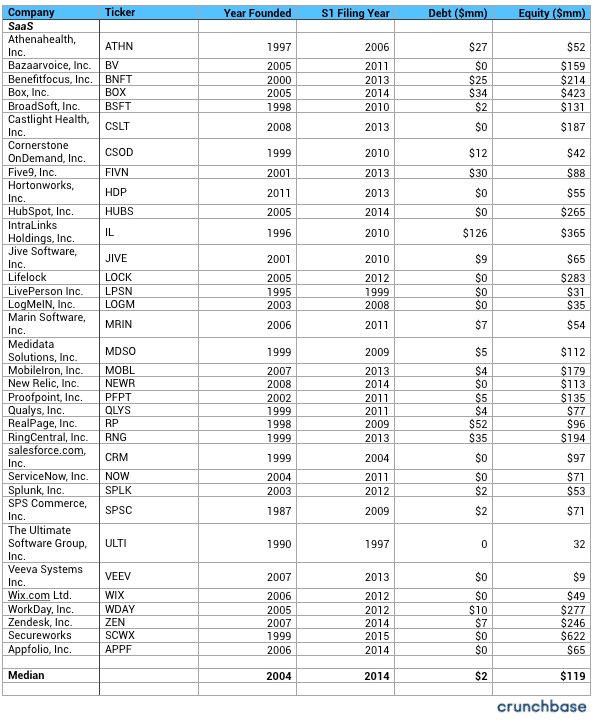

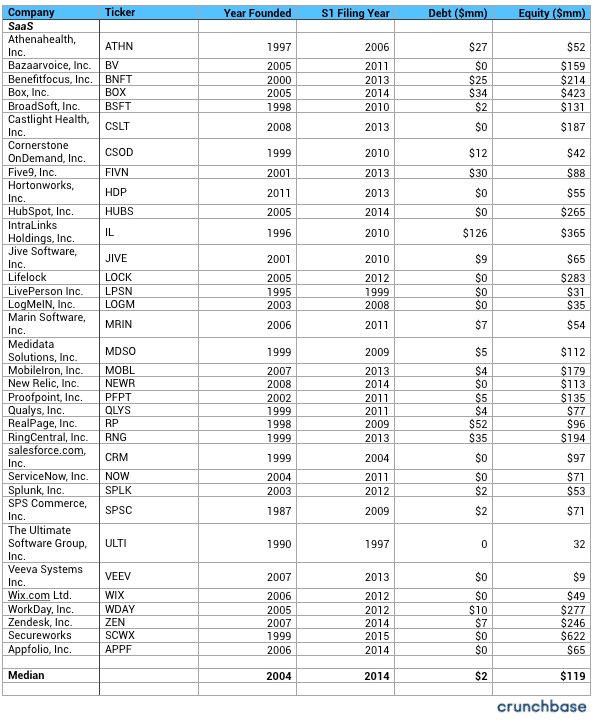

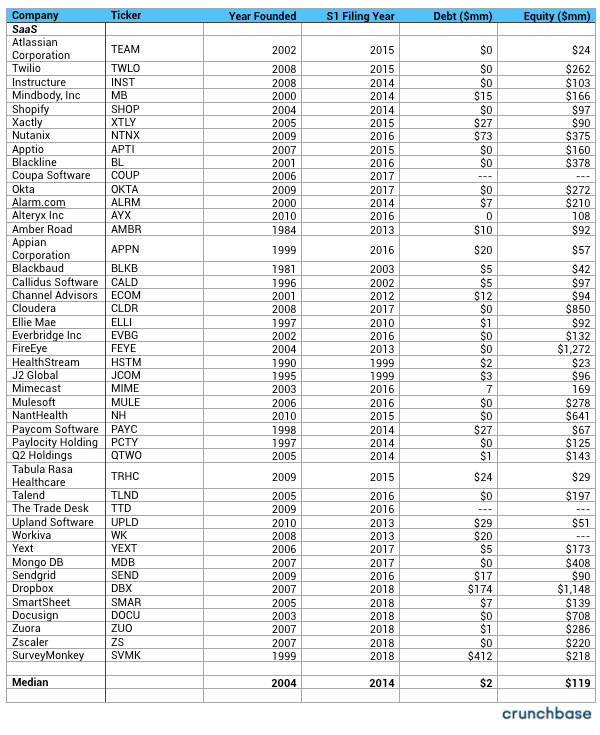

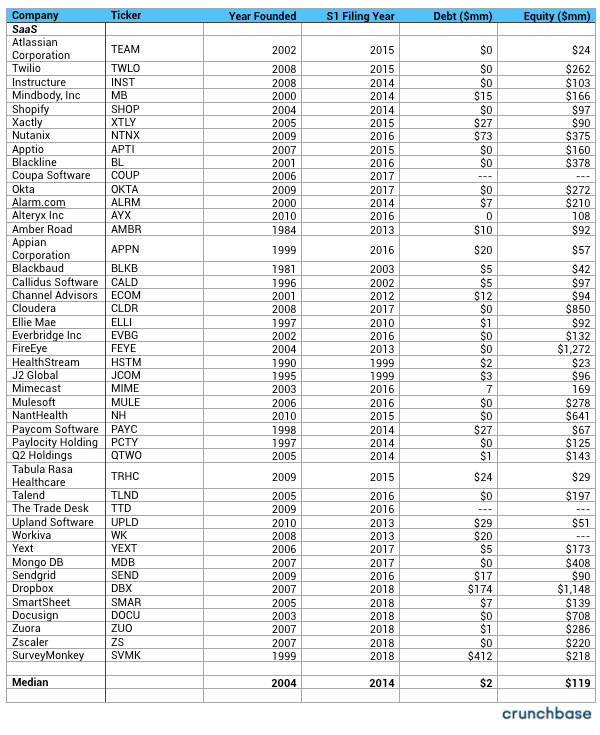

We went beyond the traditional big 4 tech companies: Google, Amazon, Facebook, and Apple. To broaden our research, we looked at the amount of capital raised by 127 tech companies prior to going public. These are some of the biggest tech companies in their respective industries.

Big Tech Companies Today

The overall theme of the data was clear: big tech companies take more money than ever, and if you don’t find yourself raising lots of money to grow, rest assured you have competitors that are. While “big” and “successful” aren’t mutually exclusive — there are plenty of small, successful companies with very happy investors and founders — we all want to be the dominant player in our space.

The cash need differs from industry

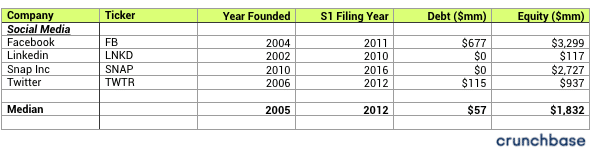

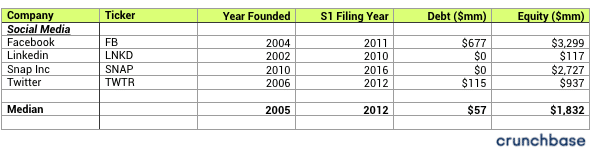

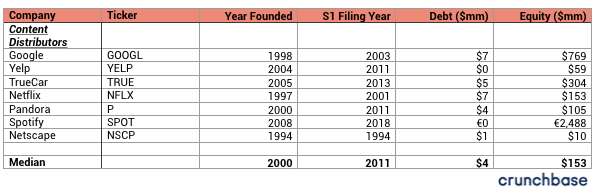

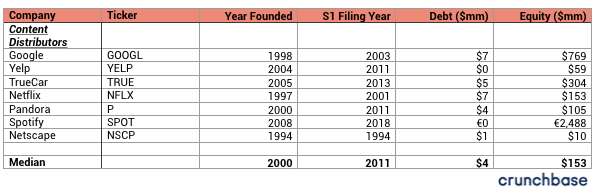

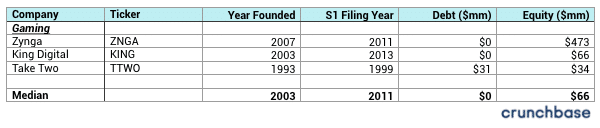

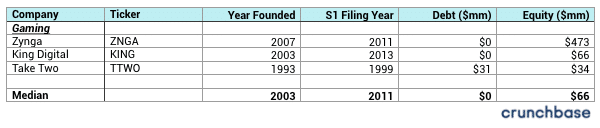

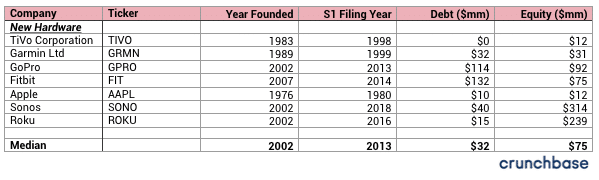

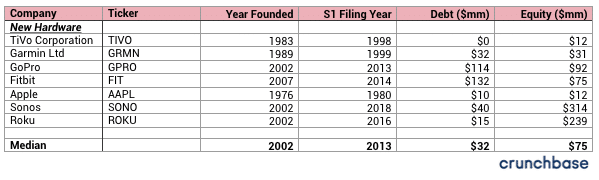

Given the data spans very diverse industries with different capital needs, it’s appropriate to look at each industry separately. For instance, because hardware companies are generally profitable quickly. The median equity raised for a hardware company that exited was only $75mm (and $32mm of debt) whereas social media companies that exited had a median of $1.8bln.

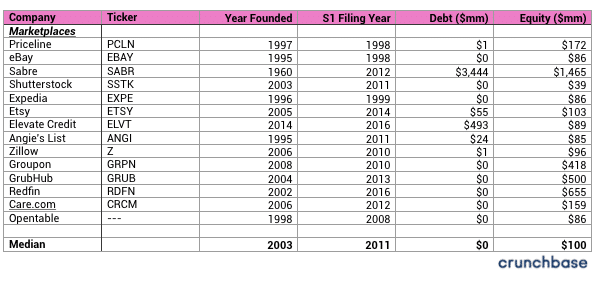

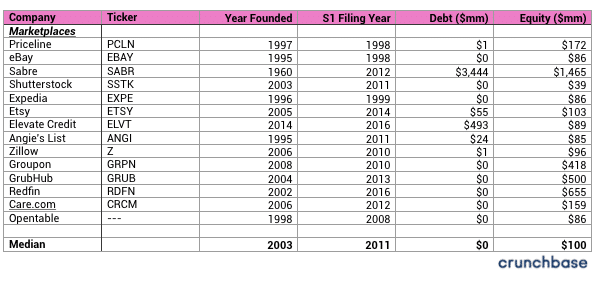

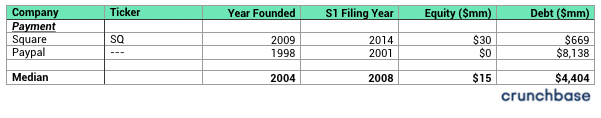

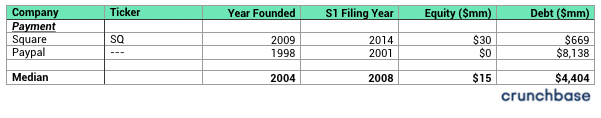

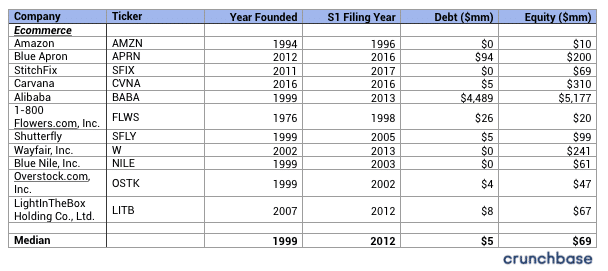

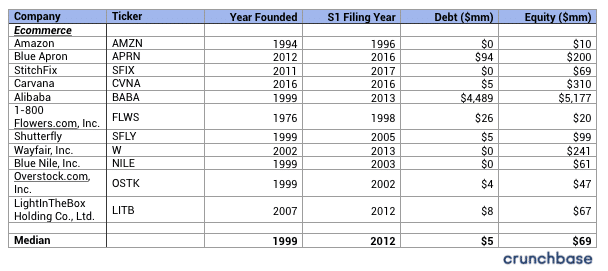

Big tech companies in the marketplace sector took $100mm, content distributors took on median $153mm, and e-commerce took $69mm. E-commerce tends to be profitable quickly so again, less equity is needed.

No debt

Notice debt plays a very small part in any tech company’s capital structure. Debt plays a small role, except for in the hardware sector. Hardware had on median $32mm of debt versus $75mm of equity. Lenders tend to be hesitant to provide debt to tech companies, which often have few hard assets to collateralize and are burning cash while they grow.

Cash need has grown with time

The oldest companies on the list like Amazon, Apple, TiVo, and 1800 Flowers required very little capital relative to peers today. Equity raised by these 4 companies was $10mm, $12mm, $12mm, and $20mm respectively. This drives home the point that building a successful business takes more cash than ever.

Even looking within the same industry, you can see stark differences between old companies and new: Fitbit, GoPro, and Roku have all raised over $200mm each whereas Garmin went public in 1999 on only $63mm of capital raised.

Profitability minimizes investor need

As mentioned earlier, companies that are profitable faster need less capital. We can see this when looking at e-commerce (median equity raised of $69mm). This is particularly relative to more capital-intensive businesses like Content Distributors and Marketplaces (equity raised of $153mm and $100mm). E-commerce companies need to reach profitability quickly because the repeat sale can be infrequent and unpredictable.

“Big” and “successful” aren’t mutually exclusive. But becoming one of the largest tech companies in your space will likely take a lot of capital raised over a few rounds.

Sammy is a co-founder of Blossom Street Ventures. They invest in companies with run rate revenue of $2mm+ and year over year growth of 50%+. We can commit in 3 weeks and our check is $1mm. Email Sammy directly at sammy@blossomstreetventures.com.