When the economic crisis hit, it nearly wiped out the entire private jet industry, and it certainly destroyed JetRepublic. We went from having confidence in being able to raise over $1 billion in asset financing, to $0 – a true startup failure.

Build your entrepreneurial toolkit when you upgrade to Crunchbase Pro – try it free for 7 days.

What hit home the most was the fact that as a startup we had ticked all the boxes. We had identified what we felt was a sure market in Europe – private jet travelers who wanted high-speed jets, but with the amenities of a larger private jet aircraft. We had secured a number of the world’s leading investment banks and had invaluable government support. I also had the privilege of building a team of the finest leaders in the private jet industry.

And yet, like so many before us, JetRepublic never got off the runway. However, just because something fails doesn’t mean that all of its foundations were faulty. Likewise, a business reaping success doesn’t mean that all steps taken to get there were covered in gold. This billion dollar failure taught me that building a company of this magnitude is nearly impossible. However, with the right tweaks and control, it can be done.

Key lessons from a $1 billion startup failure

Tighten your grip on external constraints

From day one, make sure your business model has a few hurdles and external constraints as possible. Whether that’s finding a team, seeking out customers, landing funding and investors, or convincing banks to support you – the more action points needed, the higher the odds are in failure.

The likelihood of all these factors coming together nicely, and at the same time, is virtually unachievable. At JetRepublic we had an additional requirement on top of these external factors to take into consideration. Because we were building a regulated company (ie. an airline) we needed government support and approval. While this did not directly correlate to our crash, the build in our business relied on many outside players, which in the end we couldn’t control.

Control your own destiny

My advice for any startup is to, therefore, control your own destiny. Choose a logical and painless approach to launching a company, or try and remove as many external constraints as possible from the get-go. For example, use as many of the same team you had from a previous endeavor as possible.

Pick a market where you already have a substantial customer base. You can also make use of the fact that you have close contacts at a certain lending bank. Or better yet, center your business type around a model that can be built without the need for investors or banks. The less you have to rely on, the higher the chance for success.

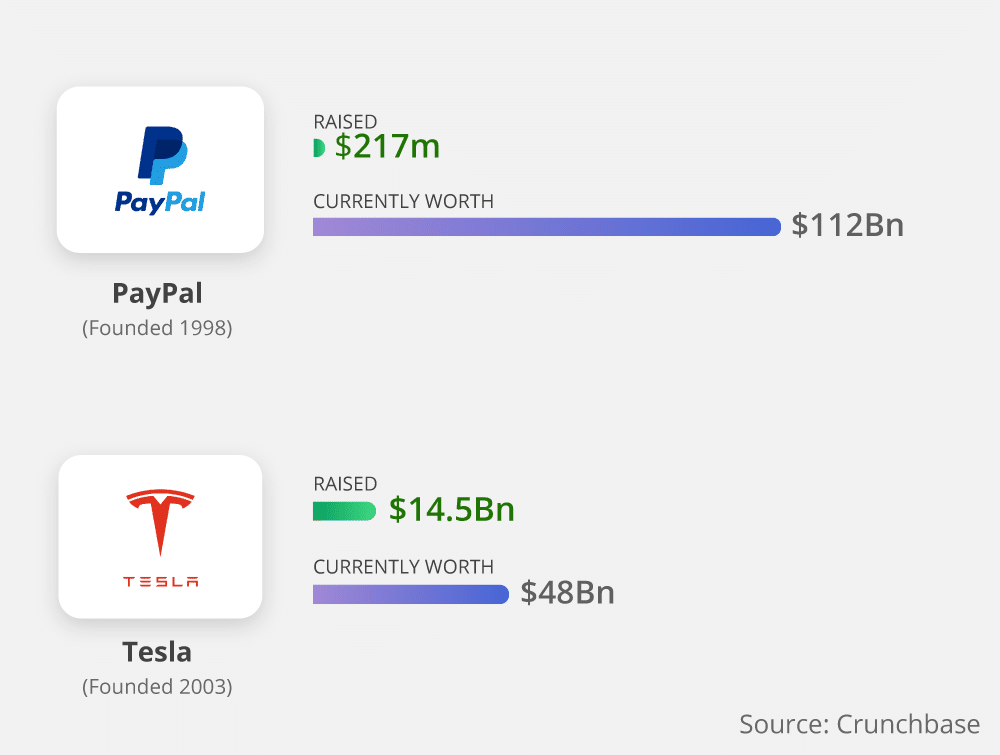

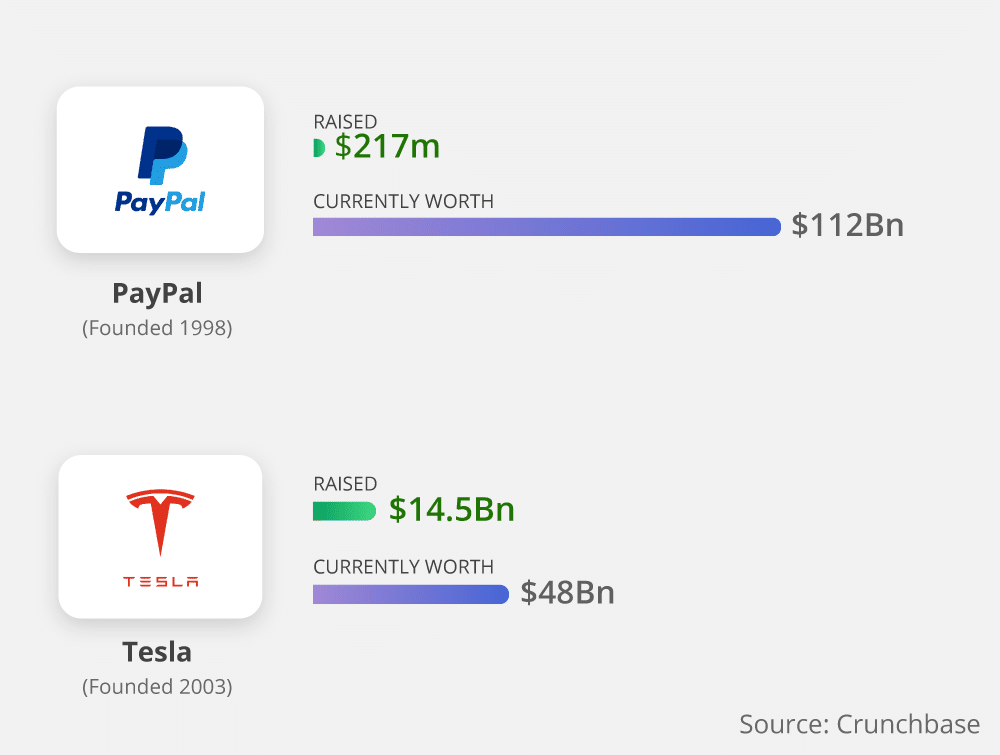

Contrast, for example, the relatively small amounts of capital that PayPal needed to become a successful payments business, versus the billions of dollars that Elon Musk needed to raise in order to build out SpaceX and Tesla. Remember that Musk was a PayPal Founder. However, he chose a far harder pathway for his subsequent companies, all of which have nearly bankrupted themselves along the years due to failure to raise capital when necessary. A far more elegant solution was adopted by Apple, who chose to outsource the entire production of its iPhone juggernaut to Foxconn. In doing so, they were able to pass on massive capital risks to its supply-chain.

Master business Jiu-Jitsu

Find a way to minimize capital exposure through Business Jiu Jitsu – using someone else’s power rather than your own. The aviation industry is similar to the real estate industry. It requires a vast amount of bank finance and external approvals (either local or governmental). However, if startups can take advantage of someone else’s work and redirect it for their own benefit then they are onto a winner. Being able to build and grow with very little capital is key to build a successful company.

Marquis Jet, for example, accomplished business Jiu-Jitsu in the private jet space by avoiding the total expense of building an airline. Instead, the company bought leases from NetJets and cut them up into smaller pieces. They then sold these pieces through “prepaid jet cards.” They were creative but on the back of someone else’s capital.

Building on a marketplace

In their case, Marquis built on the back of Warren Buffet’s Berkshire Hathaway’s capital, who had invested billions in NetJets. To build on the back of Warren Buffet is a notable achievement all in itself. In real estate, brokers like Dottie Herman have created fortunes worth hundreds of millions of dollars, yet deployed limited capital to do so. Real estate brokerage is a perfect day-to-day example of how a profitable business can be built off the backs of vast amounts of someone else’s capital – in this case, that of the real estate developer and lending banks.

Piggybacking on another’s work or resources is, in fact, a common – and often successful – strategy for many growing companies. In insurance, the smart companies will use a marketplace. Insurance companies will become a distributor rather than building millions of dollars in capital. Apple, again, thrived off this approach with its iTunes store. Rather than building something from scratch, iTunes hosts and distributes the work of others, requiring close to zero capital.

It’s all about the team

When you are restricted in terms of capital or struggling with a customer base, it will be the team around you that really matters. Finding this team is an art form. A solid team dynamic is essential for success.

An effective team is one that is not simply full of star players, but one whose output exceeds the sum of all its parts. What many startups get wrong is that they concentrate on the individual when hiring, rather than how they will complement or fit the team.

Bringing synergy to the team is arguably more important than the individual qualities of each team member. At JetRepublic we got this just right. Our first tip was hiring people that we already knew. We could then better grasp if and where they would fit. Those we didn’t know were given one-on-one time with every single member of the team to ascertain if they would get on, but more importantly, if that person would be happy working with us. When starting something from scratch I have found that behavioral fit is as important as technical fit.

In recent memory, the PayPal Mafia is probably the team that most entrepreneurs think of when asked about high-energy, mega-successful teams. They transformed the global payments industry. Then went on to invest in some of the world’s most dynamic companies, including YouTube, Tesla, LinkedIn, and Yelp.

Final thoughts on my startup failure

Starting a billion dollar company in any industry is no easy business. With JetRepublic I may have set my sights on a near impossible task. However, from the initial vision of the company to its eventual demise I learned an enormous amount. Sometimes I’m asked why I launched an online travel insurance marketplace for seniors after the failure of JetRepublic.

My answer is simple: its framework is the most capital efficient structure that I could possibly envisage. I still want to build a billion-dollar company; however, this time with a business model that has as little reliance as is humanly possible on the funding capabilities of banks or investors.![]()

![]()

Jonathan Breeze, CEO of AardvarkCompare.com, a travel insurance comparison site for seniors.