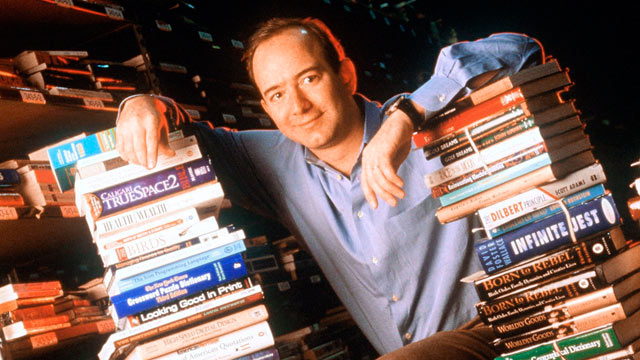

In 1996 a founder of a small startup visited 20 different investors. He raised $50,000 for less than 1% in equity. One of those investors was where his own parents, who put their life savings in the company. Those investment checks today? Worth $3.5 billion. The founder? Jeff Bezos of Amazon. Today, investors and entrepreneurs alike are chasing the Amazon dream. They are working hard and smart with the hopes of making it big. VCs are ultimately placing their strategic bets on the potential next unicorn and are looking for good companies to invest in.

Build out your entrepreneur toolbox with Crunchbase Pro.

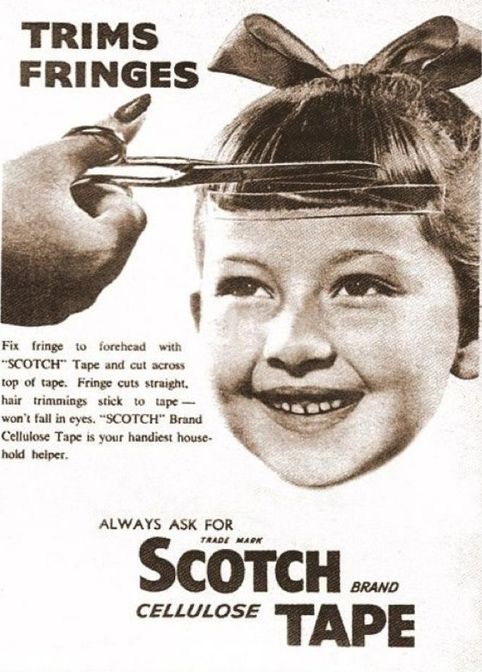

Amazon.com in 1997

Securing funding from a venture investor is one of the trickiest tasks an entrepreneur can tackle. More than just a “gut feeling,” there are specific questions – investors ask themselves before they decide if this is a good company to fund.

The best way to raise the money you want? Get inside your investor’s head. Here are the questions you want to ask yourself to be considered a good company to fund.

The questions top investors ask themselves when looking at what are good companies to invest in

Can this team lead the company to an exit?

Most investors will tell you the key to finding companies to invest in is assessing the team. The most important element is to look at the people, particularly for seed and early-stage investments, as Om Malik, Partner at True Ventures and founder of Gigaom states.

“Seed investors who are in for the long haul need to love the entrepreneur enough to have a fair and honest and constant communication while building the company.”

In addition to good chemistry between the investor and entrepreneur, investors look for solid management teams with experience and a variety of skill sets and disciplines. They want to see complementary and a diverse skill set as part of the company’s DNA when deciding if a company is a worthy investment.

Do I believe in the founder’s ability to succeed?

Investors need to see that a founder has skin in the game. That may range from working full time or at least having invested their own money into their venture. Here’s where “passion” really plays into an entrepreneur’s pitch and story.

Investors look for founders with a strong professional or highly personal understanding of the pain point they are trying to solve. Good companies to invest in are founded by “people with deep domain and functional expertise who are well suited to build a particular solution…[or] by people who very personally understand the pain point they’re solving,” according to Lauren Kolodny, principal at Aspect Ventures.

Entrepreneurs need to be living and breathing their company for success to happen.

Becca Clason / sheletsherhairdown.com

Is this a great product?

Take a step back and objectively look at your company. A critical eye is crucial to ensuring you have a great product with a competitive edge.

A great rule to follow is the “more than 10% rule” as explained by Tanya Prive CEO of Co-founder, CEO of Onevest. She explains:

“One of the saddest things I have heard from an enterprise tech company selling some new SaaS platform that is supposed to “revolutionize” their industry is: ‘we help our customers increase revenue by 10%!’”

Your product must solve a major problem or pain point in a big way, which means providing your end customers with a lot more value than just being 10% better.

Do I feel comfortable investing in this industry?

Venture capitalists typically want to invest in a sector they know and understand. Investors do this not only for their own understanding but because it is incredibly profitable for investors. Additionally, industry knowledge helps investors better parse out which companies are ordinary and which are truly remarkable.

The Kauffman Report, the largest research report on angel investing, found that “Investment multiples were twice as high when angels invested in industries they were familiar with.” An investor’s background will determine if a company is a valuable investment, not only for the VC but also the entrepreneur.

What does growth look like for this startup?

Good companies to invest in share both an extensive understanding of the market, but also strong metrics. Important metrics include annual recurring revenue (ARR), monthly recurring revenue (MRR), and total addressable market (TAM).

A good way to make certain a company is generating a steady stream of ARR is by ensuring the product has both a large and continuous demand in a big market.

Another classic example of a great investment opportunity is the lowly razor blade. In 1989, Berkshire Hathaway bought $600 million of preferred stock in Gillette. In 2005, the razor manufacturer was purchased by Procter & Gamble for $57 billion, valuing the stake at $4 billion. Not bad at all.

For monthly recurring revenue, it is helpful to look at subscription revenue, a model most SaaS companies have adopted. Showing a consistent form of revenue at a high MRR rate is a great way to show a steady earnings predictability. Depending on the baseline, 20-50% month over month growth is a good rate according to Aileen Lee of Cowboy Ventures, also taking into consideration churn, retention, and referral.

Lastly, the total addressable market (TAM) needs to be large enough. For venture investors, a sign of a worthy company is having a market that can generate $1 billion or more in revenue according to Philip Nadel, of Forefront Venture Partners. The TAM needs to be big enough to make an “upside revenue meaningful to an acquirer.”

Ultimately, the bigger the market the greater likelihood of making a sale, and the more quickly the business can grow.

The Amazon Effect

True grit and passion are contagious and can lead to real returns as seen at Amazon. There is no single formula to build a successful company but looking for what investors consider good companies to invest in can help inform how you tell your story and pitch your idea when raising funding.

Any other advice you’d like to share with entrepreneurs raising money? Let us know by tweeting at us @crunchbase.