Linked here is one of the best startup post-mortems I’ve ever read. It’s by Rand Fishkin, founder of a company called Moz. The business had fantastic growth out of the gate and took on major VC money. However, they tried to scale too quickly, letting hiring and costs got ahead of growth, and ultimately Moz had to scale back significantly.

Moz’s Startup Post Mortem

The startup post mortem is well worth the read, but below I distill the three big takeaways for me.

Avoid the Dim Glow of Big VC

The startup post mortem states:

“We’ve raised three rounds of funding: $1.1mm in 2007, $18mm in 2012, and another $10mm in January of 2016. During that stretch, we’ve grown to ~$40mm revenue run rate, mid-market size for a SaaS business.”

I don’t know the particulars of Moz’s financials, but I’m willing to bet that the company had fantastic growth and was a beautiful business before they took that $18mm round in 2012.

Photo Credit: GeekWire (www.geekwire.com)

Once they took big VC money, they had no choice but to force even greater growth and go for the huge exit. Even at $40mm of ARR they didn’t exit. This is likely because the post-money valuation set by the VC required an even larger company be built. $40mm!

If you get a big round form VC, it may seem fun initially, but the pressure and risk involved to go for the big exit will make the next 5 years much more challenging than the last 5 years, as it did for Moz.

SaaS Margins Suck

The article makes a statement I partially disagree with: “while software has high margins, it also has very few places to cut expense except people.”

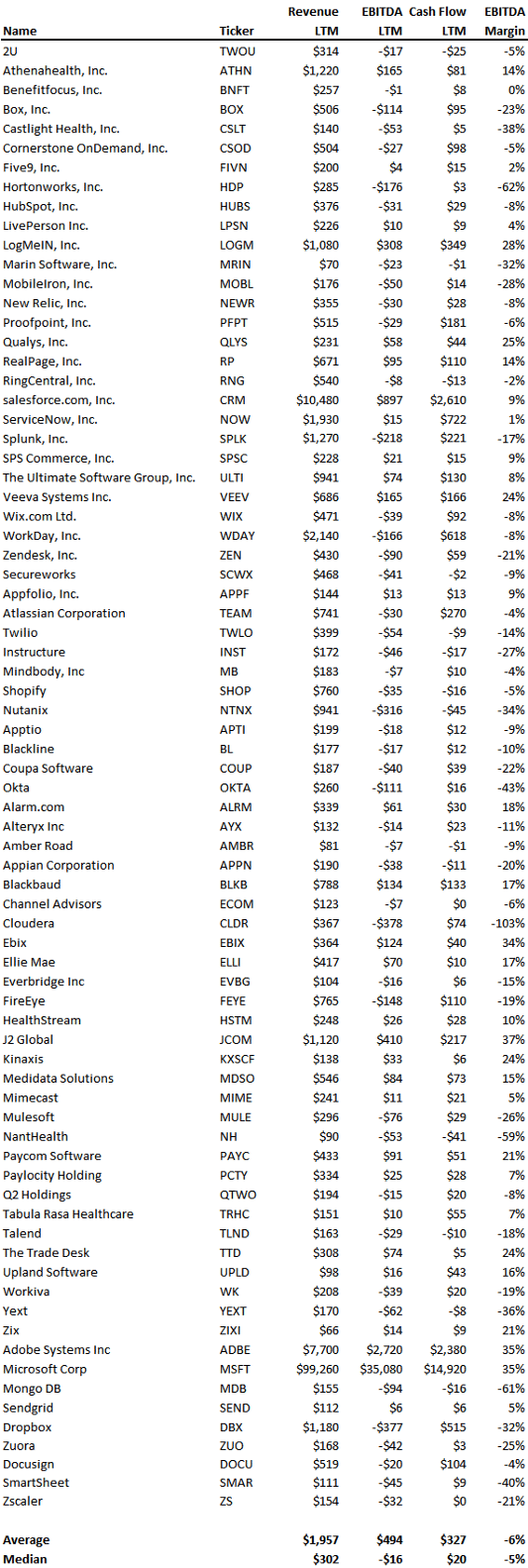

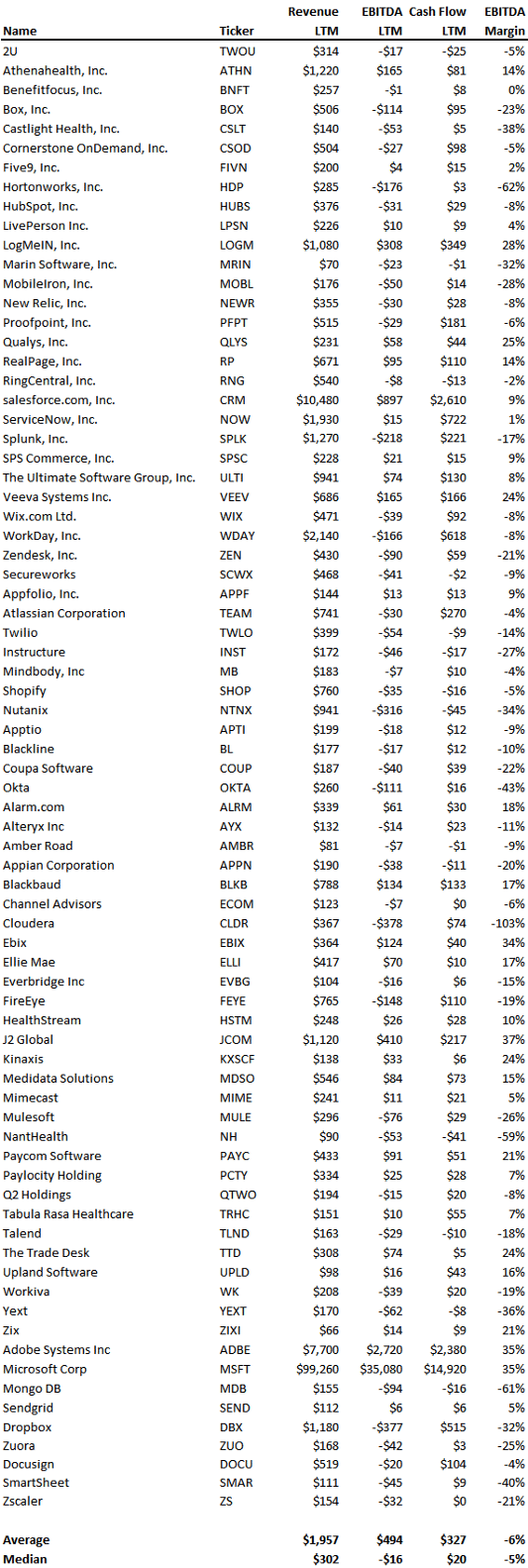

The first part of that statement is wrong while the second part is right: Software does not have high margins. It has awful margins and very high fixed costs. As the table shows, 60% of publicly traded SaaS companies have negative EBITDA and the median EBITDA margin is -5% with only 14% YoY growth.

Poor margins and high fixed costs make it extremely hard to cut costs in SaaS. Any cut is a personnel cut that you probably need such as dev, sales, customer success, etc. If you’re a SaaS business, scale carefully and within your means. SaaS’s low margins and high fixed costs make it very hard to turn back.

Restructure While You Still Have Cash

The post explains:

“With 12 months of cash in the bank and growing revenue, did Moz *have* to do layoffs in August? No. We could have carried on, done our best to limit non-personnel expenses, and tried to get growth fast enough to catch up to our expenses before we ran out of money entirely. But I believe, as did our leadership team and board of directors, that making the company cash-flow positive ASAP was the right thing to do.”

These founders truly had guts and the wherewithal to recognize a restructuring was inevitable. The founders could either make the cuts now while they still had cash on the balance sheet. Or they could burn through the cash and make very deep cuts later when they were out of cash.

The former is always the better choice although it’s harder to do. Kudos to management for being fearless.

Overall this is a phenomenal startup post mortem. All the best to the Moz team.

Sammy is a co-founder of Blossom Street Ventures. We invest in companies with a run-rate revenue of $2mm+ and year over year growth of 50%+. We lead or follow in $1mm to $5mm growth rounds and can do inside rounds, secondaries, restructurings, and special situations. We’ve made 16 investments all over the US in SaaS, e-commerce, marketplaces, and low-tech. We can commit in 3 weeks and our check is $1mm. Email Sammy directly at sammy@blossomstreetventures.com.